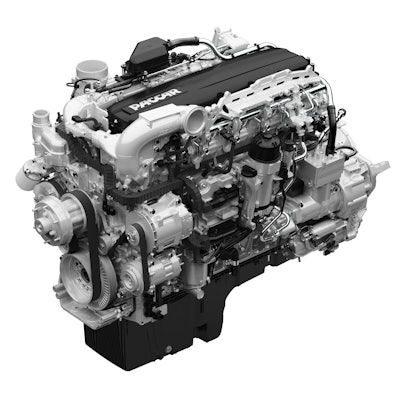

More than half of on-highway Peterbilts spec’d in 2019 had a Paccar MX-13 or MX-11 engine, leaving the others to Cummins’ larger X15. In Classes 5-7, more customers are showing interest in gasoline power.

More than half of on-highway Peterbilts spec’d in 2019 had a Paccar MX-13 or MX-11 engine, leaving the others to Cummins’ larger X15. In Classes 5-7, more customers are showing interest in gasoline power.With engineers squeezing more power from a tighter engine footprint, smaller-displacement engines have found favor with owners looking to shed a few hundred pounds while picking up a few extra miles per gallon. But they still lag far behind their large-bore counterparts.

Engines greater than 10 liters will account for more than 85% of Class 8 production between 2020 and 2024, predicts the “N.A. Commercial Vehicle On-Highway Engine Outlook,” published by ACT Research and Rhein Associates. At the same time, a trend toward smaller-displacement engines is expected to continue.

“Helped by strong tractor demand, engines over [14 liters] constitute the largest market segment in 2019, with 49% share of the over-10-liter engine market,” said Tom Rhein, president for Rhein Associates.

About 30% of all Mack’s on-highway trucks were spec’d with the company’s 11-liter MP7 engine last year. The remaining 70% were equipped with the 13-liter MP8, the largest engine available since Mack killed its MP10 16-liter engine three years ago.

The rise of engines with displacement under 14 liters makes sense, as Cummins and Detroit are the only two manufacturers of on-highway power of at least 15 liters.

Although the Freightliner Cascadia is available with a wide range of powertrain choices from Detroit or Cummins, the company isn’t seeing a notable trend toward smaller-displacement engines, said Kelly Gedert of Freightliner Trucks and Detroit Components.

“Cascadias ordered with sleeper cabs for OTR use are mainly spec’d with DD15 engines,” Gedert said. “Feedback from our customers shows strong appreciation for the performance, efficiency and the durability of the DD15.”

Peterbilt expected to close 2019 with nearly 60% of all its on-highway trucks spec’d with a Paccar MX-13 or MX-11 engine, leaving the other 40% to Cummins’ X15 – the only other engine option available for Model 579 and Model 389.

Smaller diesels aren’t the only engines gaining shares of the road. Rhein noted gasoline penetration increasing in Classes 5-7 and a rise in alternative power, notably electric and hydrogen.

“Diesel power is under attack long-term for use in on-highway commercial vehicles,” said Kenny Vieth, president for ACT Research. “While total cost of ownership calculations will ultimately determine the market for alternatively powered vehicles, it is important for decision makers to understand upfront activities, like Department of Energy spending on research into advanced vehicle technologies, repercussions for violations of the Clean Air Act, and notices and hearings for proposed regulations, like those designed to accelerate the use of zero-emissions vehicles.”

Ford was the first truck manufacturer to offer a gas powertrain on medium-duty trucks when it introduced one for its F-650 and F-750 in 2012. It’s the only manufacturer offering a choice of gas or diesel powertrains on conventional Class 6 and 7 trucks.

Isuzu has been selling gas-powered low-cab-forward trucks in the United States since 1994. Brian Tabel, marketing director, said some customers have switched from diesel to gas in recent years.

Ford Motor Co. also has noted an increase in gas selection over diesel in Classes 5-7, driven by multiple factors. “Initial purchase cost, gas is lower; maintenance over standard duty cycle time, gas is lower. However, not in all vocational applications,” said spokeswoman Elizabeth Kraft. “Gas is less costly to repair in some cases … and fuel costs.”