Find a 2021-updated version of this guide via this link -- "Get your own authority: How to tackle the basics of filing, insurance, more.

“Mustang” Mike Crawford used services of the Owner-Operator Independent Drivers Association when he got his operating authority in the year following being selected as Overdrive’s 2010 Trucker of the Year. “I paid them $805, and they did everything for me,” Crawford says. That included enrolling him in their CMCI drug and alcohol testing consortium — such enrollment is a requirement for independents.

“Mustang” Mike Crawford used services of the Owner-Operator Independent Drivers Association when he got his operating authority in the year following being selected as Overdrive’s 2010 Trucker of the Year. “I paid them $805, and they did everything for me,” Crawford says. That included enrolling him in their CMCI drug and alcohol testing consortium — such enrollment is a requirement for independents.Part 1 in this series looked at the advantages and disadvantages of running independent.

Establish your business entity.

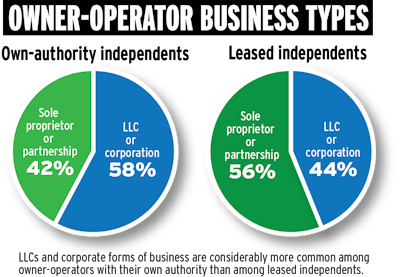

Consult with your accountant for the best business type for your operation, as all have different tax implications. Know, however, that the Limited Liability Company and various corporate forms can serve to protect personal assets in the event of an accident. Says TCRG Consulting’s Richard Wilson of the LLC form, his favored for owner-operators, “You can still be a sole proprietor, but you’re a legal business and are protected in the event of an accident.”

|

GETTING HELP | Many businesses specialize in helping owner-operators through the authority process – for a fee. A Web search of businesses in your area or a scan of the businesses advertising in Overdrive will yield more results. Owner-Operator Independent Drivers Association, ooida.com | In addition to handling the federal filings, OOIDA can serve as a new entrant’s BOC-3 process agent and handle state use-tax permits and most intrastate authority applications, UCR and Heavy Highway Vehicle Use Tax (2290) filings. OOIDA’s Norita Taylor estimates a cost of $800-$900 for getting a single-truck owner-operator set up with their “one-stop shop-type package.” This includes federal filing charges and enrollment in its CMCI drug and alcohol testing consortium, but not “insurance, plates, IFTA, intrastate authority or establishing a corporation or LLC.” OOIDA membership is $45 annually. TCRG Consulting, tcrgconsulting.com | TCRG’s Richard Wilson will handle an operator’s authority filings for $150 on top of the application fee ($300) and costs associated with BOC-3 process agents (about $100). TCRG also offers a package of compliance materials for $300 that covers required policies and associated in-office filing you’ll need to maintain in order to pass the New Entrant Audit you’ll get from FMCSA within your first 18 months of operation. Partners in Business | With the business consultants/tax specialists at ATBS, Overdrive produces the Partners in Business manual annually, with updates. It included multiple chapters on strategies toward profitable operation and one devoted exclusively to issues related to running with your own authority. You can purchase a copy of the manual ($19.95) via the eTrucker online store here. |

Get USDOT number.

There is no fee to register for your U.S. Department of Transportation number. The Federal Motor Carrier Safety Administration’s online system will guide you through the process. For those filing paper, use the MCS-150 form.

Get MC number.

Apply for authority and motor carrier number, and pay the associated $300 fee. In FMCSA’s online application system, says Wilson, checking yes to “filing as for-hire” will take you to the OP-1 form. FMCSA will issue you a lead docket number that will “eventually turn into your MC number.” After payment and FMCSA review, you’ll receive a letter with a phone number to call for confirmation.

Get insurance.

Pricing primary liability insurance can be done at any point. Taylor says OOIDA recommends to members that, after filing their business with the state, they get quotes from different insurance companies “to make sure it will be affordable.” Rates will vary depending on your driving record, your state of residence and where you plan to operate.

Owner-operators who’ve made the move toward their own authority report wildly varying quotes – from $8,000 to $16,000 annually. Regardless of your driving record, as a new business you’re viewed as risky, and you’ll pay accordingly. Operators have reported primary liability rates falling to between $5,000 and $6,000 as their businesses became established.

Once insurance is secured, have the agent file the appropriate BMC-91 form with FMCSA as proof of insurance.

|

OTHER POTENTIALLY NEEDED FILINGS | Heavy Highway Vehicle Use Tax and International Registration Plan State fuel taxes State use taxes Follow the links to state pages above for the appropriate filing systems and/or forms. |

Designate process agent.

The process agent you select will be the entity “upon whom court papers may be served in any proceeding” against your business, FMCSA notes. “Say you had a problem with fuel taxes in Maryland,” Wilson says, but you’re based elsewhere: Maryland would use your process agent to serve you.

Use FMCSA’s form BOC-3 to designate your process agent. Make certain the process agent is authorized to cover you in every state in which you operate. OOIDA functions as the process agent for many of its members, says Taylor. For operators Wilson assists, he recommends a process agent who charges a $125 startup fee and thereafter about $100 annually. FMCSA maintains a list of process agents, organized by the state where they’re based, on the Registration and Licensing portion of its website.

Complete UCR.

Complete your Unified Carrier Registration via the central hub at UCR.in.gov. The fee is $76 for carriers with one or two trucks, rising from there for more power units.

Do truck signage.

Federal regulations require any truck to have the following on both sides in a highly contrasting color: 1) The legal name of the motor carrier operating the truck as listed on form MCS-150. 2) The DOT number issued by FMCSA, preceded by the letters “USDOT.”

If you want to include your name or any other name that differs from the exact business name, the words “operated by” must precede the legal name and identifying DOT number.

FINAL INSTALLMENT IN THIS SERIES: “Do or die” compliance duties prior to the New Entrant Audit