This story is an updated version of a guide that originally ran in Overdrive‘s 2014 “Be Your Own Boss” series about moving from a leased operation to your own authority. It outlines the basics of filing requirements and procedures to get your authority, and was subsequently updated in 2019 as California-leased owner-operators in some instances were being advised to move to trucking with authority in light of the state’s contractor law then set to come into effect Jan. 1, 2020. Overdrive further revisited this guide for an update May 25, 2021, in light of record numbers of carriers seeking authority over the many months ahead of that date on the backside of the COVID-19 pandemic.

Owner-operator Isaac Ho, pictured with his 2015 Volvo, is among the many owner-operators who’ve moved to trucking with their own authority in recent years. Read more about his preps for the spot market rates crash via this link to a story from earlier this year.

Owner-operator Isaac Ho, pictured with his 2015 Volvo, is among the many owner-operators who’ve moved to trucking with their own authority in recent years. Read more about his preps for the spot market rates crash via this link to a story from earlier this year.1. Establish your business entity.

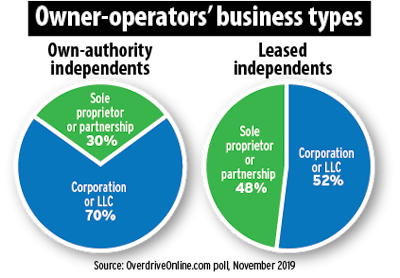

Consult with your accountant for the best business type for your operation, as all have different tax implications. Know, however, that the Limited Liability Company and various corporate forms can serve to provide at least some measure of protection of personal assets in the event of an accident -- also potentially to shield owner-operator businesses from adding potential enforcement liability to brokerage partners in California, given the potential for likely future A.B. 5 enforcement (though that legal question still remains unsettled).

The most common form of business for leased owner-operators, nonetheless, remains a sole proprietorship or partnership, where personal liability for the owner or partners is higher. Given greater risk in the independent business model, it’s no surprise that LLCs and corporations (the S Corp is the most common corporate structure for owner-operators) are set up more often there.

Between the time of a similar 2014 Overdrive survey and the results you see above, from late 2019, there was considerable movement on both leased and own-authority sides of the equation toward LLC and corporate business structures. The movement among independents with authority was more pronounced, with that share of the pie growing from just more than half to 70 percent.

Between the time of a similar 2014 Overdrive survey and the results you see above, from late 2019, there was considerable movement on both leased and own-authority sides of the equation toward LLC and corporate business structures. The movement among independents with authority was more pronounced, with that share of the pie growing from just more than half to 70 percent.If you are going to be a LLC or a corporation, file your business with the Secretary of State in your state of residence/base operation. Costs will vary depending on your state’s filing fees.

Note: If you are using your personal name and/or a “doing business as” (DBA) name as a sole proprietor, some states require that you register that also, Owner-Operator Independent Drivers Association reps say.

2. Start the Unified Registration System filing process.

Filing fees for getting your authority are limited to the $300 fee paid for the Federal Motor Carrier Safety Administration’s issuance of authority. The FMCSA’s URS online system guides new applicants through the process, during which you’ll apply for authority and receive your USDOT and motor carrier (MC) numbers, and pay the associated $300 fee.

3. Get insurance.

This is the most involved part of the process and can be thorny in this day and age for new independents. It can be done at any point in the process, but experts recommend that after filing your business type with your base state you should start getting quotes from different insurance companies to ensure affordability.

Rates will vary depending on your driving record, your state of residence and where you plan to operate. Many trucking-specific insurance agents with avenues to multiple insurance companies exist to help out in that process.

Owner-operators who’ve made the move toward their own authority report wildly varying quotes – from $8,000 to more than $20,000 or even $30,000 annually. Regardless of your driving record, as a new business you’re viewed as risky, and you’ll pay accordingly. Plenty have reported primary liability rates falling in the first few years as the businesses became more established.

Once insurance is secured, have the agent file the appropriate BMC-91 form with FMCSA as proof of insurance.

Note: A minimum coverage amount for cargo insurance, to protect your customer’s freight in transit, is no longer required coverage for carriers outside of household-goods haulers, yet many shippers still contractually do require it. Consult with your insurance agent and/or shippers/brokers you’ll be hauling for to determine appropriate coverage levels.

4. Designate process agent.

The process agent you select will be the entity “upon whom court papers may be served in any proceeding” against your business, FMCSA said. Say you had a problem with fuel taxes in Maryland, but you’re based elsewhere: Maryland would use your process agent to serve you.

Use FMCSA’s form BOC-3 to designate your process agent. Make certain the process agent is authorized to cover you in every state in which you operate. OOIDA functions as the process agent for many of its members, as does the National Association of Small Trucking Companies for its own members. A typical process agent might charge a startup fee ($125 or so) and thereafter about $100 annually. FMCSA maintains a list of process agents, organized by the state where they’re based, on the Registration and Licensing portion of its website.

5. Complete UCR.

Unified Carrier Registration is a state-level program that apportions its fairly low fee among the states annually to fund state motor carrier registration and safety-related activities. UCR's central hub at you can access via UCR.gov, where you can also do your annual registration routinely.

2020 and 2021 fees have been the same -- just $59 for carriers with one or two trucks, rising from there for more power units. That number has fallen in recent years from $76 in 2014, when Overdrive first published this guide.

Some companies offer to handle UCR filings for you — for a fee, some as high as 100-plus percent of the filing fee itself. When you place your authority application and FMCSA grants it, you will receive scads of marketing emails offering such help. It’s a best practice to carefully evaluate what you can handle yourself and whether it makes sense to pay for help. In the case of UCR, the annual filing is fairly simple with an internet connection.

6. Do truck signage.

Federal regulations require any truck to have the following on both sides in a highly contrasting color: 1) The legal name of the motor carrier operating the truck. 2) The DOT number issued by FMCSA, preceded by the letters “USDOT.”

If you want to include your name or any other name that differs from the exact business name, the words “operated by” must precede the legal name and identifying DOT number.

Reader Terry Blackwell offered this advice on signage colors: “Just remember when it comes to signage on the doors the law states it must be a contrasting color, i.e. white on black” or vice versa. “I love these guys who do a black decal on a maroon truck or dark blue where you can’t read it from 10 feet away. Play by the rules and you won’t get discouraged when you’re cited for these things.”

OTHER POTENTIALLY NEEDED FILINGS

Heavy Highway Vehicle Use Tax and International Registration Plan

If you are obtaining plates in your base state, you’ll need proof of payment of the annual federal HHVUT, which varies according to weight under load.

State fuel taxes

If you don’t already handle your own fuel taxes as a leased owner-operator, you’ll need to obtain your own International Fuel Tax Agreement account with your base state’s IFTA office when you make the switch to carrier authority. You’ll track mileage driven in each state and file the information quarterly. Account setup comes with no cost involved – simply fill out the form and file it. If you’re already handling your own IFTA, check with your state office to see what information may need to be updated to reflect new carrier authority.

State use taxes

Oregon, Kentucky, New Mexico and New York also levy separate use taxes you’ll need to track. Oregon requires monthly in-state mileage reporting, Kentucky and New Mexico quarterly. All three levy so-called “weight-distance” taxes. New York’s is similar but with more complicated calculation.

Follow the links to state pages above for the appropriate filing systems and/or forms.

GETTING HELP

Many businesses specialize in helping owner-operators through the authority process – for a fee. A Web search of businesses in your area or a scan of the businesses advertising in or written about in Overdrive will yield more results.

Owner-Operator Independent Drivers Association | In addition to handling the federal filings, OOIDA can serve as a new entrant’s BOC-3 process agent and handle state use-tax permits and most intrastate authority applications, UCR and Heavy Highway Vehicle Use Tax (2290) filings. The organization has a “one-stop-shop” sort of package that includes federal filing charges and enrollment in its CMCI drug and alcohol testing consortium, but not insurance, plates, IFTA, intrastate authority or establishing a corporation or LLC. OOIDA membership is $45 annually.

National Association of Small Trucking Companies | NASTC can assist owner-operators with some of these steps as well. The association’s independent owner-operator and very-small-fleet membership has grown quite a lot, partly as a result of its fuel program, the Quality Plus Network, which delivers substantial per-gallon discounts at in-network truck stops. As an owner-operator, getting access to the program and other services requires membership ($250 annually), which for most is predicated on participation in one of NASTC’s New Entrant Survival Training seminars, conducted monthly at association headquarters in Gallatin, Tenn., just outside Nashville.

Partners in Business | With the business consultants at ATBS, Overdrive produces its Partners in Business manual annually, with updates. It includes chapters on strategies toward profitable operation and one devoted to running with your own authority. You can download a digital copy of the manual by filling out the form at this link.

Other organizations and service companies, including factoring companies like TBS, can be avenues for assistance with the filing for interstate trucking authority, too. TBS, notably, offers a no-charge service for prospective clients, whether they ultimately use TBS for factoring or not. Other trucking associations, too, like the Western States Trucking Association, also offer filing help as a service to members.