After last week’s hopeful update, notes DAT’s Ken Harper, this week’s has March “starting to live up to its name” in spot volume and rates on DAT Load Boards.

Here’s the skinny on van, reefer and flatbed segments — check out the details hot-market maps below for a closer look at each.

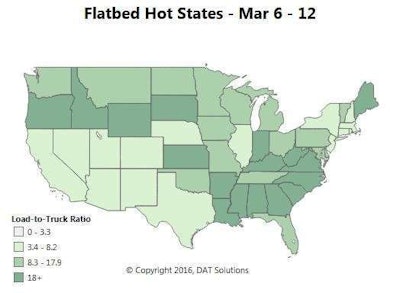

Flats

“The flatbed market is especially strong in the Southeast in some unexpected places,” Harper says.

For instance, flatbed load-to-truck ratios are soaring in Alabama and Arkansas. And rates are skyrocketing in Raleigh: after a down month, four major lanes out of Raleigh had double-digit increases last week. Outbound from Jacksonville, Fla., rates rose 18 cents to $2.45/mile.

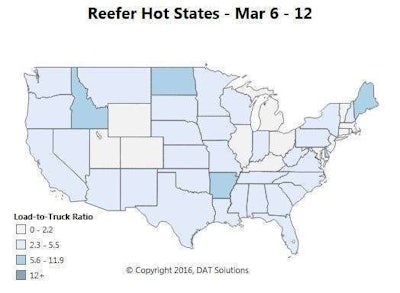

Reefers

The top lanes for spot refrigerated truckload freight saw a 10 percent increase in volume during the week ending March 12. Reefer rates are trending up in California, Texas and Florida — “all key states for springtime produce harvests,” Harper notes.

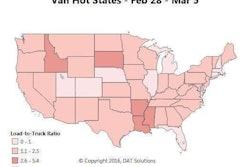

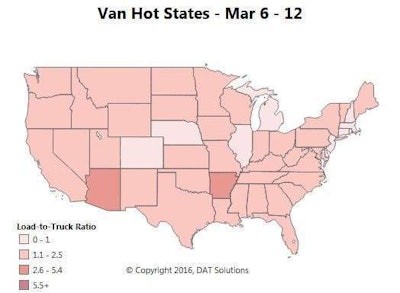

Vans

“More loads moved last week in the top 90 lanes and a steady increase in volume should put pressure on rates: we still expect them to rise in the coming weeks.”

Flatbed load volume rose 4 percent and posted truck capacity declined 5 percent last week for a 9 percent increase in the load-to-truck ratio, now at 16.1 for flatbeds — that’s well up from the 12.6 ratio in Overdrive‘s last flat update two weeks ago. While rates rose on 44 of the top 72 flatbed lanes, the national average flatbed rate fell 1 cent to $1.82 per mile. Volume is surging in areas where construction activity is picking up, though, and rates are following, including outbound from Reno (up 19 cents to $2.26 per mile), Phoenix (up 18 cents to $1.75), Harrisburg, Pa. (a 31-cent gain to $2.96), and Jacksonville, Fla. (up 18 cents to $2.45). On the downside, recent steel plant shutdowns have hurt prices on some popular lanes out of Cleveland.

Flatbed load volume rose 4 percent and posted truck capacity declined 5 percent last week for a 9 percent increase in the load-to-truck ratio, now at 16.1 for flatbeds — that’s well up from the 12.6 ratio in Overdrive‘s last flat update two weeks ago. While rates rose on 44 of the top 72 flatbed lanes, the national average flatbed rate fell 1 cent to $1.82 per mile. Volume is surging in areas where construction activity is picking up, though, and rates are following, including outbound from Reno (up 19 cents to $2.26 per mile), Phoenix (up 18 cents to $1.75), Harrisburg, Pa. (a 31-cent gain to $2.96), and Jacksonville, Fla. (up 18 cents to $2.45). On the downside, recent steel plant shutdowns have hurt prices on some popular lanes out of Cleveland. Top lanes for spot refrigerated truckload freight saw a 10 percent increase in volume during the week. Reefer rates are trending up in California, Texas, and Florida—all key states for springtime produce harvests. Those harvests have several key southern markets in transition.

Top lanes for spot refrigerated truckload freight saw a 10 percent increase in volume during the week. Reefer rates are trending up in California, Texas, and Florida—all key states for springtime produce harvests. Those harvests have several key southern markets in transition.**West: Ontario, Calif., including the Imperial and Coachella valleys, had a nice gain last week as the average outbound reefer rate jumped 11 cents to $2.11/mile.

**South Central: Rates out of the Rio Grande Valley rose again, especially from McAllen to Dallas, where the average rate surged 21 cents to $2.40/mile.

**Southeast: Southern Florida remains slow to ramp up. Rates slipped another 10 cents out of Miami despite a big bump in volume on lanes from Miami to Baltimore and from Miami to Atlanta.

The national average spot van rate slipped 1 cent to $1.55 per mile, but overall trends were mixed. More loads moved last week in the top 90 lanes and a steady increase in volume should put pressure on rates: we still expect them to rise in the coming weeks. Regionally, average van rates improved across the Sun Belt in markets like Memphis (up 1 cent to $1.79), Dallas (up 2 cents to $1.49), and Atlanta (up a penny to $1.57). Northern markets like Chicago (off 4 cents to $1.75) haven’t found the same traction.

The national average spot van rate slipped 1 cent to $1.55 per mile, but overall trends were mixed. More loads moved last week in the top 90 lanes and a steady increase in volume should put pressure on rates: we still expect them to rise in the coming weeks. Regionally, average van rates improved across the Sun Belt in markets like Memphis (up 1 cent to $1.79), Dallas (up 2 cents to $1.49), and Atlanta (up a penny to $1.57). Northern markets like Chicago (off 4 cents to $1.75) haven’t found the same traction.