“Bad news, good news,” says DAT’s Ken Harper, looking at the spot market picture on DAT Load Boards within the last week — less freight, suggesting the typically “Summertime Blues” this time of year may finally be settling in, a little later than usual. At the same time, though, van and reefer rates remained well above June averages, and flatbed rates rose nationally.

If the typical lull is under way, that “brings to mind another song title,” Harper says. “See you in September” for more freight and better rates.

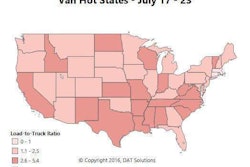

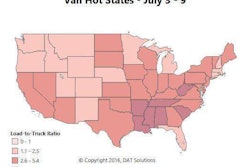

Geographic demand continues to shift as the maps below make clear — fewer loads and declining rates in the states that are furthest to the South, and an increase in activity just a little farther to the north. For example, look for rates to rise in Fresno instead of L.A., and in Memphis instead of Atlanta.

You can always find a load in Atlanta, but it may pay less than it did in June. Rates declined on most northbound lanes out of Atlanta and Charlotte last week. Memphis rates mostly held steady, but a 15-cents-per-mile spike on the lane to Columbus was a bright spot in an otherwise quiet week. Pricing was relatively stable in the Northeast and Midwest, but dropped down slightly in Dallas and Houston. Rates also drifted down in Los Angeles.

You can always find a load in Atlanta, but it may pay less than it did in June. Rates declined on most northbound lanes out of Atlanta and Charlotte last week. Memphis rates mostly held steady, but a 15-cents-per-mile spike on the lane to Columbus was a bright spot in an otherwise quiet week. Pricing was relatively stable in the Northeast and Midwest, but dropped down slightly in Dallas and Houston. Rates also drifted down in Los Angeles. Reefer freight volume declined last week, and rates adjusted after a surprising spike right after July 4. Bright spots last week were literally all over the map: The Rio Grande Valley and Mexican border crossing market at McAllen, Texas, had strong traffic and rising rates last week. Reefer freight volume is building in Fresno, so look for rates to trend up there, even as volume and rates decline in L.A. Outbound rates continue to rise in Elizabeth, N.J., close to warehouses, the East Coast’s largest sea port, and farms in the more rural areas of the Garden State.

Reefer freight volume declined last week, and rates adjusted after a surprising spike right after July 4. Bright spots last week were literally all over the map: The Rio Grande Valley and Mexican border crossing market at McAllen, Texas, had strong traffic and rising rates last week. Reefer freight volume is building in Fresno, so look for rates to trend up there, even as volume and rates decline in L.A. Outbound rates continue to rise in Elizabeth, N.J., close to warehouses, the East Coast’s largest sea port, and farms in the more rural areas of the Garden State. Compare this flat demand map to the last one featured in our weekly update, June 30. Not much has changed but for a fall-off in Texas demand and growth in the Pacific Northwest. Nationally, flatbeds added 4 cents per mile in the last week.

Compare this flat demand map to the last one featured in our weekly update, June 30. Not much has changed but for a fall-off in Texas demand and growth in the Pacific Northwest. Nationally, flatbeds added 4 cents per mile in the last week.