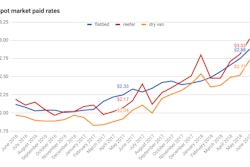

While truckload capacity has been tight all year, pushing up rates, the dynamic has eased gradually in July in somewhat typical seasonal fashion (though spot market conditions are still hotter than at the same time in prior years when it comes to being favorable for truckers).

Rates hit all-time highs early in the month, but the seasonal decline – though prices are much more elevated than usual — has seen rates fall on 76 of the top 100 van lanes this last week.

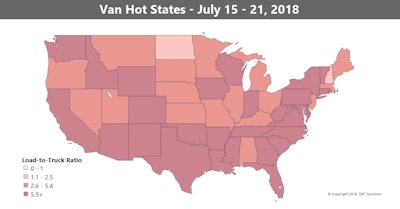

You can see in the map, there’s still a band of high load-to-truck ratios across the southern half of the country, meaning that shippers and brokers have a harder time finding trucks in those areas. However, some individual markets have cooled substantially recently.

You can see in the map, there’s still a band of high load-to-truck ratios across the southern half of the country, meaning that shippers and brokers have a harder time finding trucks in those areas. However, some individual markets have cooled substantially recently.Hot van markets: Volumes were strong in Los Angeles and Houston last week, but outbound rates were down pretty much everywhere. A handful of lanes had big increases, though. For example, the Pacific Northwest has been one of the weakest regions for outbound rates, but average rates on the lane from Seattle to Stockton, Calif., were up 17 cents to an average of $1.49 per mile. That doesn’t sound impressive, but it’s at least a sign that the Northwest is starting to stabilize.

Not so hot: It’s gotten easier to find trucks across the Southern band of states where load-to-truck ratios are high, compared to how it was in June. Average rates in Southeast markets like Atlanta, Charlotte and Memphis have retreated from their previous peaks.

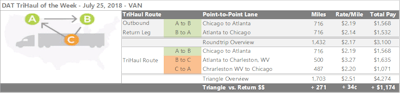

Speaking of Atlanta, it’s one of the country’s largest freight markets, as is Chicago. But if you’re making runs between the two cities, a two-leg route on the lane into Chicago, given Atlanta’s late softening, could offer opportunity to get closer to what the roundtrip was commanding in both directions in June. Currently the lane from Chicago to Atlanta pays $2.19 per mile on average, and the lane from Atlanta back to Chicago pays $2.14. Not terrible, but if you’ve got the hours to make it work, you could look for a load going from Atlanta to Charleston, W.Va., instead of heading straight back to Chicago. That lane paid an average of $3.27 per mile last week. The last leg of the trip to Chicago is averaging better too, at about $2.20 per mile. Your total rate per loaded mile for the run would get a 34-cent-per-mile increase compared to the regular roundtrip if the freight’s there.

Speaking of Atlanta, it’s one of the country’s largest freight markets, as is Chicago. But if you’re making runs between the two cities, a two-leg route on the lane into Chicago, given Atlanta’s late softening, could offer opportunity to get closer to what the roundtrip was commanding in both directions in June. Currently the lane from Chicago to Atlanta pays $2.19 per mile on average, and the lane from Atlanta back to Chicago pays $2.14. Not terrible, but if you’ve got the hours to make it work, you could look for a load going from Atlanta to Charleston, W.Va., instead of heading straight back to Chicago. That lane paid an average of $3.27 per mile last week. The last leg of the trip to Chicago is averaging better too, at about $2.20 per mile. Your total rate per loaded mile for the run would get a 34-cent-per-mile increase compared to the regular roundtrip if the freight’s there. Reefer rates fell rapidly once we got past the Fourth of July, but unlike the dry van trends, the declines for reefers weren’t across the board last week, with rates moving higher in several areas.

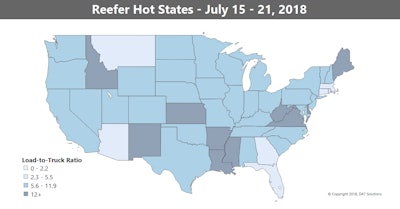

Reefer rates fell rapidly once we got past the Fourth of July, but unlike the dry van trends, the declines for reefers weren’t across the board last week, with rates moving higher in several areas.Hot reefer markets: Prices continued to climb out of Michigan, and outbound rates in Grand Rapids were up 5 percent. Sacramento, Calif., also rebounded, with the average reefer rate on the lane to Denver jumping up 38 cents to $2.96 per mile.

Not so hot: It was a different story in Southern California. The recent heat wave damaged a portion of the avocado crop, which took a bite out of volumes and rates. For example, the average rate for reefer loads moving from Ontario, Calif., to Chicago plunged 63 cents to $2.24 per mile.