Spot refrigerated freight rates rebounded with a 4-cent boost in average rates during the week ending Nov. 10, as volumes began to build ahead of the Thanksgiving holiday, noted DAT Solutions.

Meanwhile, a “bubble” of van freight moved east from Los Angeles, where ports have seen an influx of Asian imports in recent weeks.

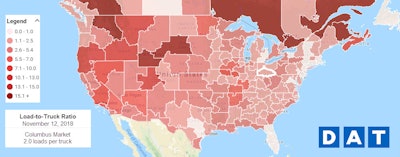

This Hot Market Map shows how the need for trucks in the West, where imports from Asia were coming into ports over the past several weeks, is moving east (the darker the red, the greater the load-to-truck ratio). Columbus, this week’s Market to Watch, stood at just 2 loads per truck with this snapshot. Watch to see how that changes as we approach Black Friday and the holidays. (Average rates in this report are derived from DAT RateView. DAT load boards overall average 1 million load posts per business day.)

This Hot Market Map shows how the need for trucks in the West, where imports from Asia were coming into ports over the past several weeks, is moving east (the darker the red, the greater the load-to-truck ratio). Columbus, this week’s Market to Watch, stood at just 2 loads per truck with this snapshot. Watch to see how that changes as we approach Black Friday and the holidays. (Average rates in this report are derived from DAT RateView. DAT load boards overall average 1 million load posts per business day.)National Average Spot Truckload Rates

Van: $2.09/mile, unchanged compared to the previous week

Reefer: $2.45/mile, up 4 cents

Flatbed: $2.43/mile, down 2 cents

National Average Load-to-Truck Ratios

The number of trucks posted to DAT load boards increased 4.4 percent versus a 1 percent gain in the number of available loads last week. Average load-to-truck ratios:

Van: 5.2 loads per truck

Reefer: 7.0 loads per truck

Flatbed: 17.4 loads per truck

Van Freight

Though Black Friday’s just around the corner, the national average van rate held steady as volumes were higher in major retail freight markets in the Midwest. Freight from California ports is moving east and showing up as rising outbound volumes from Chicago, Columbus and Memphis. There appears to be ample capacity to soak it up, which is keeping rates in check.

Market to Watch: Columbus, Ohio

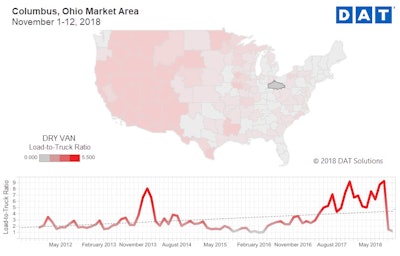

Columbus, Ohio, is a retail freight hub and a popular destination right now. With plenty of trucks in the market, van load-to-truck ratios have tracked fairly low recently (2.0 loads per truck on Nov. 12, as noted above) and outbound rates have been trending down ($2.39/mile as an average last week, down 1 cent compared to the previous week). Lanes to and from Memphis are the exception, with rates rising in both directions (Memphis to Columbus is associated with retail freight).

Van load-to-truck ratios in Columbus have been on an upward trend but spiked during Q4 2017 and early 2018, during the weeks leading up to the ELD mandate and directly after. Those ratios jumped again around April 1, when ELD “hard enforcement” began, and have loosened up considerably since then.

Van load-to-truck ratios in Columbus have been on an upward trend but spiked during Q4 2017 and early 2018, during the weeks leading up to the ELD mandate and directly after. Those ratios jumped again around April 1, when ELD “hard enforcement” began, and have loosened up considerably since then.Columbus is growing in importance as a regional freight hub because it’s well positioned between Chicagoland and the East Coast populations centers. Indeed, roundtrip averages between Columbus and East Coast markets improved week over week:

Columbus-Allentown, Pa.: $2.41/mile, up 2 cents

Columbus-Atlanta: $1.98/mile, unchanged

Columbus-Memphis: $2.02/mile, up 4 cents

Columbus-Chicago: $2.61/mile, up 3 cents