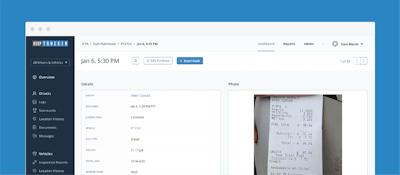

New features of the KeepTruckin ELD’s International Fuel Tax Agreement accounting functionality include the ability for drivers to easily enter fuel purchase information at the point of purchase.

New features of the KeepTruckin ELD’s International Fuel Tax Agreement accounting functionality include the ability for drivers to easily enter fuel purchase information at the point of purchase.For small fleets utilizing KeepTruckin’s electronic logging devices in tandem with its IFTA fuel tax accouting features, part of the company’s Plus plan, truckers in the field can now enter information about their fuel purchase right at the point of purchase. That data, then, automatically gets recorded and categorized as as fuel purchase in the carrier’s systems. Admins, the company says, no longer have to reconcile paper entries or download records from other places within the administrator navigation, ultimately saving time for back-office managers filing IFTA reports.

Additionally, KeepTruckin customers that use Comdata or EFS fuel cards can import data directly from either of these providers by downloading a .csv file from Comdata or EFS and uploading that very same file to KeepTruckin via the bulk import option. For customers who do not use a fuel card but are looking to take advantage of bulk importing, KeepTruckin made its custom .csv template flexible to support multiple date and time formats, state abbreviations and multiple units of measure.

The IFTA filing deadline for the current quarter is January 31, 2019.