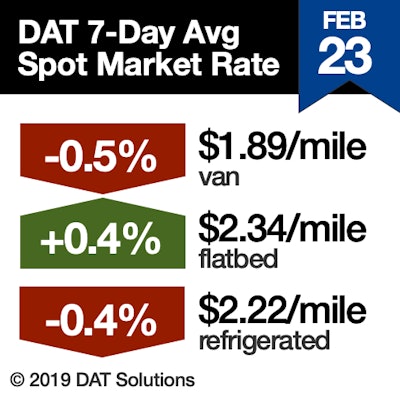

Spot truckload rates continued their slide in reefer and van segments last week, but freight volumes suggest that pricing is about to rebound, said DAT Solutions, which operates the DAT network of load boards.

While the overall number of loads posted on the DAT network fell 6 percent and truck posts increased 3 percent during the week ending Feb. 23, van volumes in February are almost 10 percent higher year over year. Van rates weakened nationally but were stable in core lanes from top markets. And diesel prices, which are a component of spot rates, have been in the $3/gal. range for several weeks after a four-month, 40-cent slide.

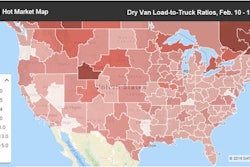

While the overall number of loads posted on the DAT network fell 6 percent and truck posts increased 3 percent during the week ending Feb. 23, van volumes in February are almost 10 percent higher year over year. Van rates weakened nationally but were stable in core lanes from top markets. And diesel prices, which are a component of spot rates, have been in the $3/gal. range for several weeks after a four-month, 40-cent slide.National average load-to-truck ratios

Van: 4.3, down from 4.8

Flatbed: 25.1, down from 27

Reefer: 5.5, down from 5.8

Trend to watch: Reefer freight

Maybe this section should be called Avert Your Eyes.

The number of reefer load posts dropped 5 percent last week and the load-to-truck ratio has been mired in the mid-5s. The national average reefer rate has fallen for seven straight weeks: In the top 72 reefer lanes by volume last week, rates on 26 lanes were up, two were neutral, and 44 slipped lower.

Some lanes settled down after weather-related spikes the previous week. Others are just down, period:

**Nogales, Ariz., to Dallas plunged 33 cents to $1.89/mile.

**Green Bay, Wis. to Minneapolis fell 28 cents to $2.25/mile.

**Miami to Boston dropped 26 cents to $1.74/mile.

**Grand Rapids, Mich., to Atlanta moved down 20 cents to $2.45/mile.

Market to watch: Atlanta vans

This is more of a macro issue than a week-over-week trend, but Atlanta has captured the top spot for van volumes in the DAT Top 100 lanes report, beating out Los Angeles.

While the average outbound rate from Atlanta declined 2 cents to $1.98/mile last week, there have been plenty opportunities — some of them good, some not so good — on core retail-freight lanes showing rate growth in the last month:

**Atlanta to Memphis: $1.64/mile, up 5 cents

**Atlanta to Columbus, Ohio: $1.55/mile, up 8 cents

**Atlanta to Philadelphia: $2.00/mile, up 3 cents

The sputtering reefer market is a drag on van rates because reefer trucks compete for van freight during slow periods. With produce season coming around and reefer carriers returning to their routine hauls, we should see Atlanta van rates pick up on big-volume regional lanes like Atlanta to Miami and Atlanta to Lakeland, Fla.