Spot rates softened after a solid start to May — the number of load posts on the DAT network of load boards fell 11% last week, said DAT Solutions.

Truck posts, meanwhile, increased 5% in the latest down indicator for spot market demand for truckers.

Load-to-truck ratios were lower for all three equipment types. These trends run directly counter to what we expect to see during the second week of May, when spot rates and volumes typically build.

The national average reefer load-to-truck typically begins to increase in April as produce season kicks into gear. That ratio has fallen steadily this year to 2.3 for the month of May as of this point. The ratio averaged 7 in May 2018.

The national average reefer load-to-truck typically begins to increase in April as produce season kicks into gear. That ratio has fallen steadily this year to 2.3 for the month of May as of this point. The ratio averaged 7 in May 2018.National average spot rates through May 12

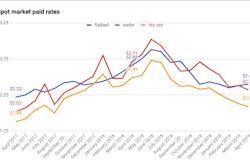

**Van: $1.81/mile, same as the April average

**Reefer: $2.19/mile, 4 cents higher than April

**Flatbed: $2.33/mile, 1 cent lower than April

The price of diesel fuel fell 1 cent to $3.16 per gallon as a national average.

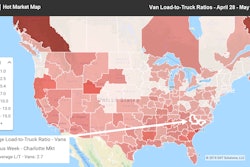

Trend to watch: Van rate negotiations

Van freight activity tends to ramp up in May, and in fact volumes are about 3% higher year over year overall. But last week the number of posted van loads plummeted 11% compared to the previous week and the national average spot van load-to-truck ratio stepped down from 1.8 to 1.5. Any ratio below 1.75 indicates that shippers and brokers could have an edge in rate negotiations, DAT reps note.

Dig in where you can/where it makes sense.

Market to watch: California reefers

Volume on the 72 largest reefer lanes rose a total of 8% last week, which should have sent rates and load-to-truck ratios higher. While the national average reefer rate improved a penny, the load-to-truck ratio fell from 2.9 to 2.3 last week. With farmers in the Midwest recovering from a bad spring, that ratio has fallen steadily from 4.0 in January to 2.3 in mid-May. As noted under the graphic above, the ratio averaged 7.0 in May 2018.

On the plus side, California is presenting opportunities for reefer haulers. Volume was higher in Los Angeles (by 18%) compared to the previous week, and average outbound rates increased from Fresno, Calif. ($2.23/mile, up 3 cents) and Sacramento ($2.60/mile, up 7 cents). Sacramento to Salt Lake City jumped 25 cents to $2.57/mile.