As is often the case in a week following a fall in load-to-truck demand indicators on the load boards, national average spot truckload rates dipped last week as capacity returned to the market after the Fourth of July holiday, said DAT Solutions, operators of the DAT load board network.

Load-posting volume increased markedly, however, recovering the 45% loss during the previous week when many businesses reduced their schedules, and then some. Truck posts increased just 21%.

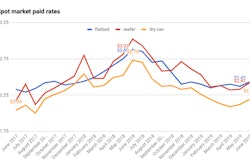

National average spot rates, through July 14

*Van: $1.88/mile, 1 cent lower than the June average

*Reefer: $2.24/mile, 1 cent lower than June

*Flatbed: $2.29/mile, 1 cent lower than June

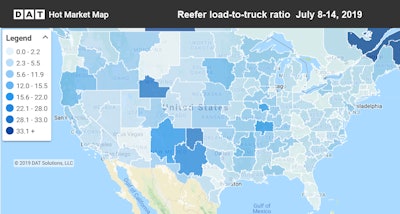

Reefer load-to-truck ratios fell last week in key agricultural markets, including Texas, Arizona, and California. Darker shades indicate more load posts compared to truck posts.

Reefer load-to-truck ratios fell last week in key agricultural markets, including Texas, Arizona, and California. Darker shades indicate more load posts compared to truck posts.Trend to watch: Slowdown in reefer markets

Unlike the van market, reefer volumes were slow to regain their pre-holiday levels. It’s a sign that agricultural activity is slowing in produce-oriented areas in Texas, Arizona, and California.

The national average reefer load-to-truck ratio made a modest gain from 3.5 to 3.8 last week but rates were lower on 55 of the DAT Top 72 reefer lanes following the previous week’s general fall in demand indicators.

Indeed, eight reefer markets gave up more than 4% of the prior week’s rate, led by Nogales, Ariz., down 7.4% to $2.21/mile; Atlanta, down 6.5% to $2.52/mile; and Los Angeles, down 6.4% to $2.93/mile.

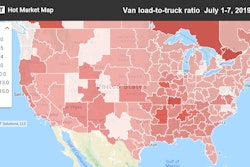

Market to watch: Vans out of Memphis

Last week, spot van rates from Memphis fell an average of 5% compared to the previous week. One reason is Tropical Storm Barry, as truckers—eager to escape the bad weather—flooded Memphis with capacity. Another reason is seasonal: soft pricing is typical following the Fourth of July holiday. Spot van rates on the DAT Top 100 van lanes fell 3%, wiping out gains made over the past four weeks.

Load counts, however, remain solid. Are we on the cusp of a “freight recession,” as some analysts have speculated recently? Not as long as volumes are showing strength, especially in bellwether van markets like Memphis.