Spot load-to-truck ratios for all three equipment types fell during the week ending Jan. 26 and truckload rates for vans and reefers drifted lower as shippers had little trouble finding trucks to haul their freight, said DAT Solutions, which operates the DAT load board network.

The current lull may be shorter than expected, but there’s no doubt that for now conditions on the spot market favor shippers — and demand a creative approach from truckers.

National average spot rates for the month, through Jan. 26

**Van: $1.90 per mile, down 4 cents from the December average

**Reefer: $2.27 per mile, down 3 cents from December but 9 cents higher than November

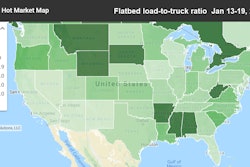

**Flatbed: $2.18 per mile, unchanged from December

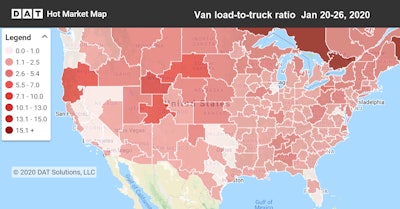

The national average van load-to-truck ratio slipped from 2.1 to 1.6 last week. As detailed above, rates were sliding, too.

The national average van load-to-truck ratio slipped from 2.1 to 1.6 last week. As detailed above, rates were sliding, too.Trend to watch: Truckload capacity

As shown in the caption to the graphic, load-to-truck ratios fell further last week for vans. And for the second straight week, the average van rate was lower on nearly all of DAT’s top 100 van lanes. Rates were higher only on lanes that tend to come in quite low for rates in the first place.

Compared to the previous week, van volume on the spot market was generally neutral and indeed there’s a decent amount of freight out there considering the time of year. It’s just not paying well.

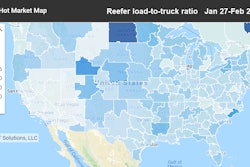

Reefer carriers are in similar straits. This is something of a quiet period for reefer freight, which is closely tied to domestic fresh produce harvests. The national average reefer load-to-truck ratio was 3.8, down from 4.9 the previous week. As a result, the average spot rate fell on 71 of DAT’s top 72 reefer lanes by volume. The sole riser was Grand Rapids, Michigan, to Madison, Wisconsin.

Tighter capacity, with fewer trucks looking for freight, could firm up the rate picture. With bad weather in the forecast across the northern U.S., anybody planning a vacation?

Market to watch: Memphis vans

The good news is you can almost always find van loads in a Southeast retail hub. The bad news is it’s hard to find lanes between these markets that pay well right now. For instance, Memphis to Charlotte fell 14 cents to $1.95 a mile last week, while the return trip lost 9 cents to $1.45.

It’s a shipper’s market, so get creative. Look for loads to smaller markets where you can triangulate the return. Loads from Charlotte to Macon, Georgia, are currently averaging $1.95 per mile. Macon to Memphis: $2.11.

The roundtrip between Memphis and Charlotte averaged $1.76 per loaded mile last week for a total of $2,166, around 600 miles each way. The three-legged return through Macon averages $2.05 a mile, which at that rate would earn you $2,806 while adding about 140 miles, and possibly part of another day depending on delays, to the trip. If it works with your schedule and hours of service, triangular routing could be a good choice in a tough rate environment.