Trucking news and briefs for Tuesday, May 26, 2020:

New hours of service rule set to take effect in late September

The Federal Motor Carrier Safety Administration’s recently announced hours of service changes will take effect Tuesday, Sept. 29, according to the final rule that is set to be published in the Federal Register June 1. Though FMCSA did not list a date yet, the rule is slated to be published June 1 and will become effective 120 days after that — Sept. 29.

As reported earlier this month, the changes include expanded split-sleeper berth options; allowing the 30-minute break to be taken in on-duty, not-driving status; allowing an additional two hours to be added to the driving window for adverse conditions; and expanding the short-haul exception from 100 air miles to 150 air miles.

For the amended split sleeper berth provisions, drivers will now be allowed to split their 10-hour off-duty period into windows of seven hours and three hours, in addition to the existing eight-hour and two-hour option. Additionally, the shorter window in any split of off-duty time will not count against drivers’ 14-hour on-duty clock, unlike with current regs.

For the 30-minute break, in addition to the duty status change, drivers will now be required to take the break within their first eight hours of driving, rather than their first eight hours on-duty.

Petitions for Reconsideration of the final rule must be submitted to FMCSA within 30 days of the rule’s publication in June 1.

U.S. Treasury issues interim final rules with guidance on PPP loan forgiveness, application

Following debut of the official application borrowers under the Paycheck Protection Program will use to apply for forgiveness of the loans, which you can access here, U.S. Treasury published two interim final rules intended to give borrowers and lender partners to the Small Business Administration official guidelines on qualifying uses of the funds and more.

The first rule, effective immediately and issued with usual notice and comment periods given the emergency status of the program, details just what borrowers can expect related to “which payroll costs and nonpayroll costs that are incurred or paid during the covered period are eligible for forgiveness,” the rule states. As has been reported previously and is reiterated in the rule, categories of forgivable expenses include:

(1) Payroll costs (which must equate to at least 75% of the total amount of the loan used to be forgiven)

(2) Interest payments on any business mortgage obligation on real or personal property that was incurred before February 15, 2020 (but not any prepayment or payment of principal);

(3) Payments on business rent obligations on real or personal property under a lease agreement in force before February 15, 2020; and

(4) Business utility payments for the distribution of electricity, gas, water,transportation, telephone, or internet access for which service began before February 15, 2020.

The second interim final rule requests comment on PPP loan forgiveness application processing procedures for 30 days post-publication. You’ll be able to comment on it in the docket at Regulations.gov under docket No. SBA-2020-0033 when it’s posted there on June 1.

Mack produces, donates PPE to local businesses near production plant

Mack Trucks recently donated approximately 500 pieces of personal protective equipment that the company manufactured at its Lehigh Valley Operations plant in Macungie, Pennsylvania.

The company produced face shield headbands utilizing its 3D printer, as well as hand-crafted assembly at the plant that produces Mack’s Class 8 trucks. It also recently began producing 3D-printed ear guards for more comfort for employees wearing face masks.

The equipment was first given to employees then donated to various organizations, including Lehigh Valley Health Network, Lehigh Center, Kirkland Village, Westminster Village and the Eaton Home. Mack will donate more PPE pieces as they are produced.

Mack also recently donated $10,000 to the Second Harvest Food Bank of the Lehigh Valley and Northeast Pennsylvania.

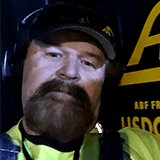

John DeGood

John DeGoodArkansas-based trucker named Highway Angel for stopping and helping at accident scene

Arkansas-based truck driver John DeGood has been named a Highway Angel by the Truckload Carriers Association after stopping to help a passenger van driver following a collision with a fracking trailer.

In the early morning hours of Dec. 3, DeGood was traveling eastbound on Highway 315 near Clayton, Texas, when he came upon an accident scene where a van had collided with a trailer loaded with fracking equipment. He maneuvered around the accident, made a U-turn and returned in the westbound lanes. As he did, the driver of the fracking trailer slowed by did not stop at the scene.

DeGood said a piece of the trailer’s DOT bumper was lying in the road and that the van had veered off the road and into trees. He positioned his truck to shine the headlights on the scene and used his four-way flashes as warning signals. He then grabbed his flashlight and went to check on the driver of the van, who told him he was having chest pain. DeGood called 911, and emergency vehicles arrived a few minutes later.

“He told me he’d had open heart surgery a few years ago,” DeGood said. “He said he had medication with him and asked me to help him find it, but he was so jumbled up in there, I couldn’t find anything. He said he didn’t see the trailer. It must have been coming off of a dark road and pulled onto the highway.”

For his willingness to help, DeGood was presented with a certificate, patch, lapel pin and truck decals. His carrier, ABF Freight System, also received a certificate acknowledging their driver as a Highway Angel. EpicVue sponsors the TCA Highway Angel program.