Spot truckload rates and volumes continued to climb last week as businesses looked to regain their footing and produce harvests fed supply chains with van and refrigerated freight.

National average van, reefer and likewise flatbed rates rose in response to an 18% increase in the number of loads posted during the week ending June 7, said DAT Solutions, operator of the DAT load board network. It’s a typical seasonal pattern for the month of June in some ways, yet for owner-operators like Forrest, Ill.-based Warren Hartman, who operates a three-truck mostly flatbed fleet, it can’t come soon enough, given the depth of the bottom hit just more than a month ago.

Hartman’s been supplementing longer-haul flatbed loads for himself and his two drivers out of the Midwest, loading back in with brokered freight, with local ag work to maintain revenue and income awaiting some semblance of normalcy in the markets. In the “second week of June now,” he said this week, “we have seen an uptick in business since last month.”

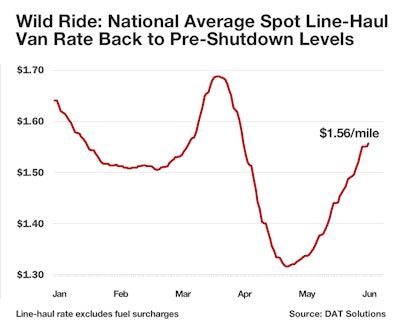

With the uptick in spot market volumes DAT notes for last week, truck postings grew, too, by 13% compared to the previous week. Clearly, plenty owner-operators are returning to the market in search of good-paying loads. As activity levels have improved, fortunately, so have rates, shown below as average linehaul, minus a calculated fuel surcharge to separate out diesel’s volatile effects.

After a rocky 12 weeks, the national average spot van rate is back where it was prior to U.S. economies contracting in response to the spread of the COVID-19 coronavirus.

After a rocky 12 weeks, the national average spot van rate is back where it was prior to U.S. economies contracting in response to the spread of the COVID-19 coronavirus.National average spot rates (with fuel) through June 7

**Van: $1.75/mile, 15 cents higher than the May average

**Flatbed: $2.01/mile, compared to $1.90 in May

**Reefer: $2.10/mile, 8 cents above May’s average

Those are rolling averages for the month of June. On June 1, the van spot rate averaged $1.72 a mile, the flatbed rate was $1.98, and the reefer rate was $2.08.

Trend to watch: A milestone for flatbed freight

The coronavirus pandemic was an unexpected shock to the economy in March and April, but flatbed carriers have endured additional volatility in energy, construction, steel, heavy machinery and other industrial markets that use their services.

Last week, load volumes increased 2.2% on DAT’s top 78 flatbed lanes and the national average flatbed load-to-truck ratio touched above 21. Last June the average ratio was 20 loads per truck, the high-water mark for 2019. Load volume from Houston, the country’s busiest flatbed freight market, was up 2.6% compared to the previous week although the average outbound rate gave up a penny to $1.95/mile. Nationally, spot flatbed rates are still well below last year’s levels when the average for June was $2.30/mile.

Market to watch: Chicago vans

Spot rates were higher on 72 of DAT’s top 100 van lanes by volume compared to the previous week, and the number of loads moved on those 100 lanes was up by an average of 28%. The national average van load-to-truck ratio dipped from 2.8 to 2.7, however, as truck posts grew on the spot market.

Load volumes out of virtually every major van market increased by double-digit percentages, including Chicago. The average outbound rate increased 6 cents to $1.99/mile last week, and is up nearly 20 cents over the past two weeks. Key lanes with gains:

- Chicago to Columbus, Ohio, rose 19 cents to $2.34/mile

- Chicago to Detroit gained 15 cents to $2.78

- Chicago to Allentown, Pa., was up 13 cents to $2.32