The annual open-enrollment period for health insurance plans secured through the Affordable Care Act's marketplace begins on November 1 and runs through January 15. For drivers and owner-ops, this year represents an opportunity to capitalize on what might be the last big cash grab of the great pandemic: health care subsidies.

A relative few owner-operators in Overdrive's audience -- 16% -- have purchased insurance through the ACA exchanges to date, according to recent polling below. The largest portion of respondents (34%) reported they weren't covered by insurance at all at this point, while the second largest group of respondents (31%) had secured a policy elsewhere, whether a private off-exchange plan or one among a bevy of new "health ministry" cost-share group-based plans.

According to Marc Ballard, overseeing the National Association of Independent Truckers' health- and other-insurance efforts, the American Rescue Plan not only included stimulus payments, unemployment boosts, and childcare tax credits -- it also made this year a historically good time to get health care on the ACA exchanges.

"This year, more than any other year, is different in that more independent drivers are going to be able to afford health insurance than ever before," said Ballard. "Up to this year, based on your family income, people got what’s called subsidies that helped them pay for their insurance. If you made too much money, you didn’t qualify for subsidies."

Ballard's organization works with about 15,000 truckers, and he's personally seen them struggle to get coverage under the old system. For many truckers making around $60,000 a year, they simply wouldn't qualify for meaningful subsidies in 2013 or 2014.

Those drivers would have to pay "thousands a month for a family" to provide health care without subsidies, Ballard said.

But now, that's changed.

According to Ballard, the subsidies "now apply to people well into middle income America." Ballard gave an example of what a typical driver can expect to pay for health care with the new subsidies.

[Related: Health insurance savings possible for many more owner-ops after Rescue Plan legislation]

"We’re seeing about 90% of people who enroll can get a plan for $100 a month," he continued. "Take, for example, a guy who may be 45 with a spouse and two kids, lives in Florida and expenses a bunch of his income. ... Let’s say his net adjusted income is $60,000. He grossed $200,000, but the reportable income is $60,000. He could literally be paying zero dollars for a health care plan."

While these rates will vary by income and location, Ballard said it's not uncommon to see a premium plan priced at $2,500 a month and a subsidy of $2,600. "The bottom line is that he's paying nothing" in such a case, Ballard said.

For many, just a few hundred dollars a month should cover a decent plan, and Ballard said it's basically leaving money on the table to ignore these historically good conditions. To see if you qualify for the new subsidies, check this helpful link to health-insurance-info provider HealthInsurance.org.

"It’s crazy, like the wild West right now. I’ve not seen it before," Ballard added said. "Moral of the story is there’s a lot of independent drivers out there that maybe got a quote in 2013 or 2014, and they should come back. They literally could be walking away from health care."

That "wild West" feeling has extended to health care providers, as well. Ballard said that his zip code in Florida shows ten different providers competing for his business, and that insurers have come around to playing ball with the ACA after years of focusing their efforts elsewhere.

Furthermore, as Ballard and many in the trucking industry know all too well, truck drivers often have adverse health histories. The demanding job and life on the road takes a toll on the body, and there's no sense in spending hard earned money on emergency room visits and other unexpected health problems.

Just as with trucking insurances carriers and drivers are intimately familiar with, Ballard urged drivers to look into their own health and start thinking about how a health care plan can work like preventive maintenance to minimize downtime and improve quality of life.

Picking the right health insurance plan

While Ballard says there are deals to be had in insurance, it's still important for drivers to pick the right plan. On that score, Ballard says his partner association NAIT stays with drivers every step of the way.

"We’re their agents, their contacts and consultants through the whole year," said Ballard. "We don’t just put them in a plan and say you’re on your own. We’ll help them. Especially when they ask a question like 'I need a new doctor,' or 'The pharmacy didn’t cover this prescription.'"

Marc Ballard (pictured) noted the NAIT organization's Truckers Healthcare marketplace as an avenue to ACA plans and other kinds of insurance. Find NAIT reps and more information via this link.

Marc Ballard (pictured) noted the NAIT organization's Truckers Healthcare marketplace as an avenue to ACA plans and other kinds of insurance. Find NAIT reps and more information via this link.

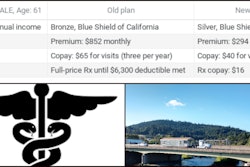

As for which plans to pick, Ballard noted the basic structure of plans ranging from bronze to platinum, with bronze plans featuring low monthly payments and high deductibles, and platinum plans costing more per month but guaranteeing lower out-of-pocket costs in case care is needed.

For drivers, the market is flooded with all kinds of health insurance products meant to bridge the gaps in a piecemeal system, so Ballard said to watch out. Many health care plans available to drivers outside the ACA offer relatively low monthly rates, but skimp out when it really matters.

"Some of these drivers have been on plans and platforms out there that cater to independent truckers that offer limited medical plans with caps like $1,000 a day in hospital inpatient or $5,000 of a surgery bill when a surgery can be tens of thousands," said Ballard. "These plans are more expensive than a regular major medical plan, and they also don't cover preexisting conditions."