Update December 10, 2024: After a federal district court in Alabama found the new reporting requirement for many small businesses detailed in this story unconstitutional in March with judgment on a lawsuit brought by the National Small Business Association -- read more about that suit via this link -- a Texas district court judge formally enjoined the reporting requirement of the Corporate Transparency Act from even being implemented, including formally halting any and all deadlines and penalties. The Teasury Department, however, planned to appeal and said it would hold open the reporting system described here as voluntary for businesses. Original story follows.

The United States Treasury's Financial Crimes Enforcement Network (FinCEN) now administers a reporting system aimed at all manner of small businesses throughout the United States. Since the first of this year, any newly established LLC, corporation, LLP and some other business types, including any owner-operator or small fleet who's filed with their Secretary of State to establish the business, have 90 days to report Beneficial Ownership Information (BOI) to FinCen and the Treasury.

The requirement is also in play for businesses that existed prior to the first of the year, noted Tim Hill, entity service manager for owner-operator business services firm ATBS. Those owner-operators and many small fleets, though, have much more time to report -- the deadline to complete the filing with FinCEN is the end of 2024.

Penalties for not doing so can be "pretty severe" by the letter of the law when it comes to the BOI reporting program, said Hill, with civil fines of $500 per day beyond a business's deadline to report, and potential criminal penalties up to imprisonment for the worst cases.

If that sounds harsh for what amounts to failure to check a few boxes on an online form, there's a reason Treasury is motivated here. The new BOI program was created as a result of the Corporate Transparency Act, legislation passed in Congress in 2021 as part of that year's Defense reauthorization package and aimed at the problem of money laundering from abroad and at home through shell companies, said Hill.

Laundering is fairly easy to do when "no one knows who owns" the company, he said, and "this is an attempt to fix that."

The good news is that reporting looks to be a fairly simple matter for most owner-operators, requiring little more than an individual owner's name, date of birth, address and identifying document like your CDL or passport. The owner applicant must identify his/her company with its name, address and Employer Identification Number (Social Security number will suffice, too, for most one-truck businesses that are LLCs, Hill said), identifying then any other individual either with "substantial control" of the business or with an ownership stake above 25%, such as they may exist.

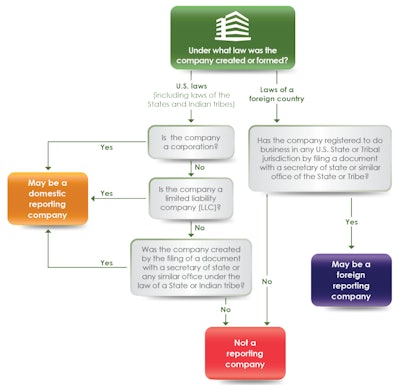

The following flowchart from FinCEN aims to help businesses quickly ID whether or not they fall under the new BOI reporting requirement.

Yes answers to the questions on the chart, part of FinCEN's Small Entity Compliance Guide, mean it's likely your business will need to report. There's a significant exemption for small fleets with 20 or more employees hitting a particular revenue target -- read on for more detail.

Yes answers to the questions on the chart, part of FinCEN's Small Entity Compliance Guide, mean it's likely your business will need to report. There's a significant exemption for small fleets with 20 or more employees hitting a particular revenue target -- read on for more detail.

Hill estimated the new requirement might apply to roughly 15% of ATBS owner-operator clientele, those who've set up LLCs or other business entities with their Secretaries of State.

Except in certain circumstances (such as if you move your business to a new home base address), it's likely you'll only need to report once in your business's life. As Hill put it, "After a single report, if you never move, you may never have to report again."

[Related: How to set up an owner-operator LLC to file as an S Corp and save on self-employment tax]

The bad news: Quick timeline for address-change deadlines with BOI reporting

ATBS initially considered whether they would be able to provide the BOI reporting service on behalf of clients, but then flagged a particular liability that was going to make that difficult. When any registered business changes its address, under the BOI reporting program's terms owners have just "30 days to report the change" to FinCEN, Hill said, with the same $500 per-day civil fines potentially applying at the end of that 30 days.

That requirement might be the most urgent among all within the program for owners on the move, given the program's newness and the short time period to report an address change.

With that tight deadline, and big penalties, ATBS felt that to be able to provide the service it would have put an even tighter timeframe on its clients making address changes with them. Ultimately, for BOI reporting, Hill said, "we’re going to be able to help out and provide some of the information" an owner might need, then recommend the owner do the filing him or herself.

Some other special cases to consider.

- Larger businesses are exempt. Exemptions to reporting exist not only for particular types of businesses, including many financial institutions, but also a large swath of "large operating companies." That's right, the FinCEN program specifically targets small entities. Any small fleet business that reaches the level of 20 full-time employees and can demonstrate $5,000,000 in revenues annually can avoid the reporting requirement.

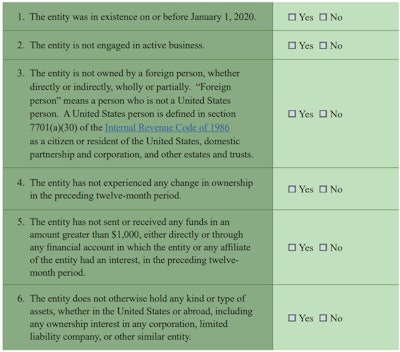

- Inactive entities. If you're not currently operating your trucking business yet haven't officially closed down the LLC entity, for instance, Hill said, "you're technically still subject to the reporting requirement" if the business was created after January of 2020. Say you're an owner who incorporated February 1 of 2020, "lived the high life" during the COVID pandemic spot-market highs then "got out in 2022 or 2023," Hill said. "You've still got to report." The FinCEN Small Entity Compliance Guide provides the following checklist for inactive entities to help determine if they qualify for the what's dubbed the "Inactive Entity" exemption.

Businesses must be able to check yes to all six of these conditions to qualify for the Inactive Entity exemption.

Businesses must be able to check yes to all six of these conditions to qualify for the Inactive Entity exemption.

ATBS's Tim Hill notes there's always been some reporting to FinCEN from entities like private equity managers and hedge funds. The "Financial Crimes Enforcement Network is not a new thing," he said. Yet "in the past they seemed only to go after bigger entities. This is the first time I've seen [the Network] applied to small entities" so directly.

Owners can get started on filing via this link to FinCEN's BOI e-filing website.

Find more information about considerations to make when choosing the right business structure for your business in Chapter 9 of the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Follow this link to download the most recent edition of the Partners in Business book free of charge.

Find more information about considerations to make when choosing the right business structure for your business in Chapter 9 of the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Follow this link to download the most recent edition of the Partners in Business book free of charge.