As the clock struck midnight on October 1, members of the International Longshoremen’s Association (ILA) walked out of three dozen facilities across 14 port authorities stretching from Maine to Texas. The strike includes more than 50,000 workers at ports where more than 40% of all U.S. imports flow through the East and Gulf Coast.

Rhetorically, the strike has reached heights of sound and fury rarely seen in American economic and political life, with ILA chief negotiator Harold Daggett saying the strike "will cripple" the economy if necessary, and the Teamsters Union, not party to the strike but standing in solidarity, telling President Joe Biden to "stay the *!!* out" of the negotiations.

The White House, for it's part, has indicated it doesn't intend to intervene, even as the port strike threatens the peak holiday shopping season around the corner.

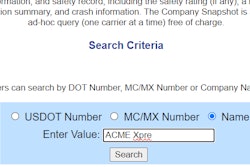

The strike certainly has major implications for trucking, particular intermodal/dray operations trucking in from ports as freight stalls. The U.S.'s East Coast ports see big volumes of electronics, auto parts and finished cars, refrigerated produce, beer and furniture. The chart below, with info provided from ImportGenius, shows the top 20 companies that import through eastern ports.

Dean Croke, DAT Freight & Analytics principal analyst, had muted expectations for any big impact on spot market rates.

“In the short term, we’d expect minimal impact on supply chains as shippers anticipated a strike and front-loaded imports earlier in the year," he said. "A prolonged strike -- longer than a week -- would be more disruptive but could create opportunities for carriers on the spot market. Freight diverted to ports in eastern and Atlantic Canada -- Halifax, Saint John, Ottawa and Montreal -- would need to be trucked into the United States. Demand for air would surge to move high-value and late-season goods like electronics and pharmaceuticals, which would need to move by truck out of air cargo hubs."

FTR CEO Jonathan Starks told Overdrive the strike had mostly been priced in by big importers. "Inventory should be available and accessible," he said. "Our assumption is a two week strike, which is long enough to create some pain in the transport markets, but not long enough to create significant pain for the consumer or the industrial supplier."

Anything longer than a three weeks or so, Starks said, would start to change that equation, "and shippers would begin to make more significant changes to their shipping patterns as intermodal facilities could start to max out."

William George, director of research at ImportGenius, said the strike likely spells "more of a problem for consumers" and ocean freight than trucking.

However, the strike could be even more short-lived than many have predicted. Just 12 hours into it, the United States Maritime Alliance has already agreed to one of the ILA's main conditions, barring automation at the ports, and said it's offered a 50% pay increase, with ILA seeking 61.5%, which is already down from the initial ask of 70%.

[Related: Intermodal haulers fight off a 'system collapse' at the ports]