Judging by spot market volume, freight hit a trough last week and turned back up the hill, albeit not far up, as it were. Around the same time, I was emailed a shipper’s daily load sheet — it showed pricing on several step deck and flatbed loads headed out from a few different facilities in the East and bound for parts West and South. One step deck load in particular was moving in the neighborhood of 1,300 miles, no tarps, and paying $3,600, according to the sheet, almost $3/mile.

The same day the shipper’s loads went out to both carrier and broker partners (as the source noted, loads from this shipper are offered up first come first served, depending on who answers the call), the load in question showed up on the DAT board — posted by a broker with an offer rate of about $2,100, almost 50 cents/mile below the DAT RateView rolling average for that lane on that date. The broker was clearly testing the market in a time when cheap has been the watchword. But even at the $1.62/mile offer, it was at least well above the truly insulting $1/mile that hasn’t been hard to find.

While I do not ultimately know if this load actually moved for the $1.62 the broker advertised, or whether the shipper may have benefited from transport savings the broker may have achieved for them, $3,600 becoming a $2,100 offer with the stroke of a few keys on the board makes for quite a discount (yeah, 40% and a little more).

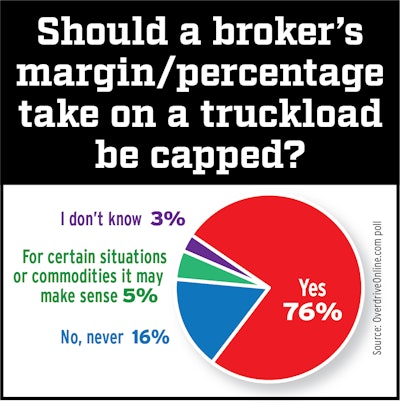

As I noted, carriers with shipper relationships get such load lists, too, thus it’s no surprise that in our current too-little-freight/too-many-trucks-and-brokers environment word would get around of this kind of spread between shippers’ rates and brokers’ offers. The following poll results, too, are unsurprising in a time like this:

Despite that overwhelming majority in favor of a cap, critics of any regulation limiting pricing were more vocal than the majority of respondents here.

Jonathan H. Lee, speaking of the government-mandated variety of a cap, noted that “if the brokers are capped at any percentage, the feds will ultimately do the same to the owners of the trucks, big and small. It’s a bad idea to limit capitalism. If you don’t like the rates don’t take the load, simple as that. If you’re not in the position to pick and choose through the available freight, maybe you should consider a different line of work.”

His was among much similar commentary.

“I don’t want more government control in this business, no matter what part of this industry it is!” wrote Harold Sheppard III. He urged owner-operators to work on negotiation tactics for markets up or down, and use them. “Build relationships with good shippers and brokers, and allow the free market to work.”

Others came back to the notion of transparency — the reality that when it comes to brokered freight in so many cases, the owner-operator just doesn’t know “what we are paying” for the broker’s service, in the words of Robert Breslin. The Owner-Operator Independent Drivers Association moved to require a kind of automated post-trip disclosure of transaction records with a push on Congress Wednesday that might be a vehicle to ensure that. Breslin seemed to favor such an approach: If owner-operators understand the freight charges and brokers’ commissions, “we can decide with whom we want to deal.”

Still, as the poll shows, many readers do favor some potential government intervention into pricing. “I’m not a big fan of regulations, but [1980s] deregulation of trucking was probably worst thing that ever happened to this business,” said Timothy Barrett, a single-truck independent owner-operator out of Tennessee. As noted in prior coverage a few weeks ago, Barrett has parked his truck due to abysmal rates and has taken temporary work at a local Walmart to make ends meet. De-regulation “allowed guys like me to have my own authority, but it created a race to the bottom” for rates, he said.

Anthony Stewart, a former owner-operator who had to come off the road after experiencing medical issues almost five years ago, has launched a freight agency contracted to the Arizona-based Truckalocity, LLC brokerage called Freightportation, with a new commitment to be fully transparent about his own commissions. He’s selling transport savings to shippers by using a pricing formula that splits the difference between what they’re paying today and lane averages, based on available data and his own experience, he says. He’s keeping a stated 10% commission, then, for himself, and both shippers and carriers know it.

Former owner-operator Anthony “Tony” Stewart now dispatches for a few owner-operators in addition to building his agency.

Former owner-operator Anthony “Tony” Stewart now dispatches for a few owner-operators in addition to building his agency.Other brokers have done similar things in the past, too, with varying success, and some digitally-enabled brokers today tie their rates, at least in part, to fluctuations in supply-demand metrics and average rates on lanes that are readily available to freight-market participants, if their formulas are murky at best for the casual observer/their carrier partners.

Stewart, he says, offers his “Max 10” program in an effort to push back against what he sees indeed in some cases as the “reverse price gouging” carriers have invoked so much of late as a cudgel against perceived opportunistic actors in the market downturn. He says he recognizes the dynamic himself from his own days as an owner-operator, and hopes to “use our Max 10 program to both reduce [shippers’] costs and help carriers get a better rate.” —James Jaillet contributed to this report.