See Part Two of the ELD Data Grab series at this link:

The second part in this series will follow this month’s installments in July.

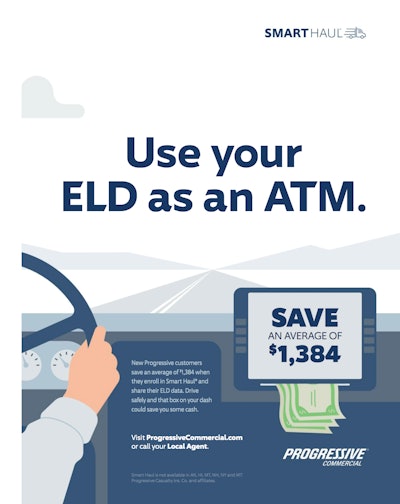

The second part in this series will follow this month’s installments in July.How much is your e-log data worth? By one count, a discount offered by Progressive Insurance, it knocks off an average of $1,384 from premiums of users willing to share data from their electronic logging devices. If other insurers have similar offers, they haven’t made them known widely, though one insurer confirms to Overdrive it’s moving in similar directions.

Behind-the-scenes interest among ELD vendors and other parties in drivers’ location and driving behavior, among other data recorded by ELDs, raises questions of how to control the data and who should profit from it.

“It’s kind of the classic move now in all sectors,” says Karen Levy, a sociology professor at Cornell University, whose research concentrates on data privacy and technology and who is penning a book on the ELD mandate. “The data becomes a currency itself. It obviously has value to the people purchasing it, and none of that is accrued to the people producing it.”

By agreeing to terms of service with an ELD provider, customers often grant permission for data sharing, possibly without realizing it. The providers can use the data for customers’ benefit, such as by helping carriers address detention problems by offering them analytics on dock delays. However, providers also are monetizing the data in other ways, such as selling it to third parties or using it to further other business interests of their own.

“Are you surprised? I’m not,” says David Owen, head of the National Association of Small Trucking Companies, about the demand for ELD data. “We’ve turned the world over to technocrats.”

Among 14 ELD providers – serving more than 80 percent of the total market, based on Overdrive research – interviewed or surveyed by Overdrive, none admitted selling ELD-derived datasets, though at least one has a user agreement that allows it by default. Four declined to answer questions on the topic.

Yet there’s no doubt that the data sharing is off and running, whether as an outright sale, as a company’s spinoff product or as part of a new joint venture. Many data-share applications are freight-related – often load matching and location tracking – and aggregate data for anonymity.

Fuel stops become part of ELD data by virtue of location, fuel economy and time spent off the road. Some ELD providers can provide customers with time and other metrics about their own fuel stops for comparison to others in the ELD network, potentially valuable for analysis of route choices.

Fuel stops become part of ELD data by virtue of location, fuel economy and time spent off the road. Some ELD providers can provide customers with time and other metrics about their own fuel stops for comparison to others in the ELD network, potentially valuable for analysis of route choices.Data firm FreightWaves purchases data from ELD suppliers and carriers, says Daniel Pickett, a data scientist. He works on the company’s Sonar product, a data aggregation dashboard that details freight rates, fuel prices and more, with a strong geographic and segment-related element enabled in some instances by access to e-log data.

The provider of the Trucker Tools smartphone app and Smart Capacity load-matching service has spoken of efforts to leverage location data to track dock delays. Trucker Tools also has integrated more than one ELD provider’s devices with its services for the purposes of using the ELD to power its tracking service.

KeepTruckin, provider of an ELD popular among owner-operators, is using its customers’ ELD data and a brokerage acquisition to expand into freight matching and related services, including detention-time monitoring.

The BigRoad ELD provider operates a load-board-like service called BigRoad Freight, as does Konexial with its GoLoad service in partnership with a transportation management software provider for shippers.

Load board provider Truckstop.com is building data connections with major ELD suppliers to its carrier customers and has partnered with the Dock411 facilities information and review service. Many other load-tracking technology providers have integrated with ELD systems.

FleetOps was founded with the intention of partnering with ELD/telematics providers, assuming that “a lot of them will need some solution to help them extract additional dollars from existing customers,” says Chris Atkinson, chief executive officer. The company’s technology underlies the BigRoad Freight load-matching offering.

On the insurance front, where Progressive is leading the way in using ELD data by discounting insurance premiums, the insurer views data on an individual level, offering owner-operators and small carriers discounts of between 3 and 18 percent on premiums.

Owner-operators voluntarily submit their ELD data, usually in concert with their ELD supplier, via a one-time file transfer, so Progressive does not access ELDs directly. Dave Lubeck, a business consultant for Progressive, says the company looks at the data only once a year to make a determination about insurance premium discounts.

However, a concern about an insurer getting such granular behavioral data is that it has the potential to “expose the vulnerabilities” of an individual driver or carrier and increase premiums, Atkinson says. “That’s where you don’t want things to go,” he says. “We always want these things to work for us, not against us.”

This ad touted Progressive’s premium discounts on average for truckers supplying ELD-derived information to the company.

This ad touted Progressive’s premium discounts on average for truckers supplying ELD-derived information to the company.Rishi Arora, a product development manager for Progressive, says the company will reassess operators’ discounts each year, potentially rolling back any premium discounts if driving behavior worsens. But drivers still will receive the 3 percent discount off their baseline premium for submitting their data, Arora says.

In Canada’s Ontario province, where Atkinson lives, it’s illegal for insurance companies to use telematics data to raise rates, he says, but not to reduce rates.

In the United States, “there isn’t anything limiting the use of data” to raise rates, says Pete Frey, director of commercial lines telematics for Nationwide Insurance. State insurance commissions approach insurers’ use of telematics-derived data in different ways, he adds. As long as companies are “clear and transparent in how we’re using” customer data, most states, Frey believes, will continue to see telematics data “as a way to improve safety and be fair and equitable.”

That’s how Frey’s company views data derived from ELDs, cameras and other in-cab devices. Use of such behavioral driving data to raise premiums “would be extremely contrary to the purpose of telematics at Nationwide,” he says. “We’re thinking about ways to reduce costs” for customers and the insurer.

Insurers have approached Trimble (formerly PeopleNet), one of the nation’s largest ELD providers, about acquiring aggregate and individualized ELD data, says Eric Witty, vice president of products. But the company will provide such data only if customers sign a data-sharing agreement, he says. Customers would define access limits, such as what data points to share, but so far “we haven’t enabled any of those integrations,” Witty says.

Trimble’s boilerplate user agreement for the PeopleNet Connected Driver app, which pairs with a carrier’s fleet management system as an ELD, at once, does allow for disclosure of “aggregated information about Our users, and information that does not identify any individual or device, without restriction.”

Witty sees “risk assessment” value for insurers and carriers in sharing ELD data. “The incentive for carriers is to get lower premiums.”

The use of telematics data generally remains in its infancy in the commercial vehicle market, says Jeff Moseler of Michigan-based Navigator Truck Insurance Agency. Outside Progressive’s program, he’s not seen commercial liability insurers in trucking connecting premium rates to telematics-derived driving data — not directly, in any case.

“If you have a driver scorecard system,” Moseler says, “what a lot of agencies and insurers are working on is a way to take the telematics data and combine it with other resources like the CSA (Compliance, Safety, Accountability) record of inspections and violations, and score the drivers so you know who the ones are that are causing their problems and have a policy to correct the behavior.”

With such a program in place, they say, the underwriting process will be more accurate and potentially reduce rates. Moseler likens it to how insurers treat carriers’ use of camera systems. “They’re not actually looking at video, but they are asking, ‘What type of camera programs do you have in place? Forward- and/or rear-facing? What’s your policy on that?’” and pricing accordingly.

Next in this series: ELD data handling: ‘Privacy is paramount,’ but practices vary