Previously in this series: Missing reins in an emerging marketplace for ELD data

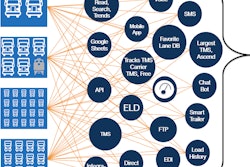

Location data is some of the most valuable output from electronic logging devices, driving tracking services to make deals with ELD providers.

The five-year-old Project44, which serves large brokers, third-party logistics providers and shippers, is one that’s looking to integrate its location service with as many ELD providers as possible.

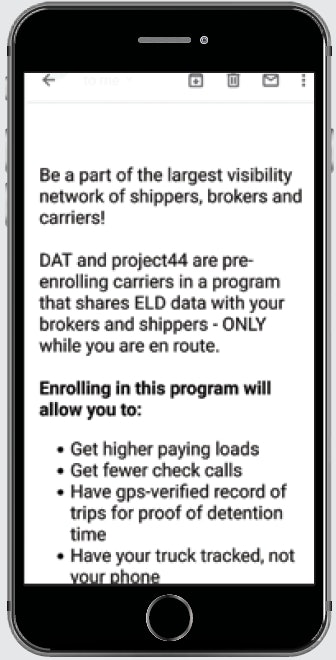

This email solicitation touts a tracking integration with the DAT load board. Given Project44’s far-reaching tracking technology in different transportation modes, including across the Atlantic, the trucker who forwarded the email to Overdrive wondered whether this represented some kind of “new world order” for spot market freight.

This email solicitation touts a tracking integration with the DAT load board. Given Project44’s far-reaching tracking technology in different transportation modes, including across the Atlantic, the trucker who forwarded the email to Overdrive wondered whether this represented some kind of “new world order” for spot market freight.Vernon O’Donnell, the company’s chief customer officer, described still ongoing talks over ELD integration with DAT not as a direct route toward better freight, even though the emailed solicitation on this page touts “higher paying loads.” Instead, he stresses the integration as a way for truckers to opt in to Project44’s tracking service, among few services operating in the U.S. that is fully compliant with the European Union’s General Data Protection Regulation (GDPR), when pulling a load booked through the board with a broker/3PL using the service.

The ELD would provide the location data connection between the carrier and the customer broker/shipper. Information on hours of service or other unrelated data would not be shared.

Trucker Tools and Descartes Macropoint have leveraged ELD location data further. They’ve allowed for a connection to truckers’ ELDs to feed location and other data into algorithms to suggest load matches from brokers on the other end of the service.

Macropoint’s freight co-op allows truckers to share their availability for loading, and the company’s integration with more than 100 ELD providers enables carriers to allow brokers and shippers a window into a load’s location. Data privacy is handled on an opt-in basis.

If a new carrier is using an ELD not integrated with Macropoint’s tracking system, that gets set up, says Brian Hodgson, a vice president. If the carrier’s using an ELD already set up, “there’s a permissions process through which the carrier opts in to share ELD data with that customer.”

How some customers then use any historical data is centered primarily around en-route location and timing, the ability to predict transit times on particular loads, etc. Descartes Macropoint itself doesn’t do much now in terms of taking carrier data and layering aggregated, anonymized analytics on dock time, time in transit for particular lanes and more for individual customers, but that’s coming, says Hodgson.

Load board Truckstop.com, purveyor of its own load track functionality, also is headed toward a “predictive” matching capability, says Brent Hutto, chief relationship officer. The company is creating data connections with the ELDs most commonly used by Truckstop.com carriers.

“ELDs provide another piece of the puzzle” when it comes to information that can be brought to bear in matching freight (hours available), he says, yet “you still have to have freight for that information to be valuable.”

Hutto describes eventual integration of drivers’ hours of service status as a way to help put load offers in front of drivers who not only are close enough to the load but also have the available time to meet deadlines.