Simple formulas used in owner-operator insurance acquisition, such as driver health and age and number of out-of-service violations, soon could take a back seat to big data and more sophisticated algorithm-driven coverage and rates.

And that could mean better rates for safer operators and coverage for other operators who may have not been able to obtain it prior, says Mike Miller, Progressive Insurance’s director of commercial vehicles.

I was able to sit down with Miller at the recent Mid-America Trucking Show in Louisville, Ky., to talk about Progressive’s coming changes to the way it determines rates and coverage for owner-operators, along with how his company uses CSA data and the DOT’s potential insurance increase rule.

Relative to CSA, Miller says Progressive does not use the percentile rankings produced in the program’s Safety Measurement System BASICs. Instead, he says, Progressive uses the raw violation data to produce its own scoring — an element of the company’s upcoming rating structure. Use of the raw data, he says, paints a more credible picture of an owner-operator’s safety history.

The company’s use of the raw violation data rather than the percentile rankings also could quell some operators’ fears of third parties, such as insurers, using the rankings against them, as they often present a skewed view of an operator’s safety history, as Overdrive reporting has shown.

Progressive’s new structure, however, is still in the works, so Miller couldn’t share too much about exactly what other coefficients will play a role. But he did say the owner-operator rating structure could allow it to better reward those with good safety records by lowering their premiums. It could also allow it to insure operators that previously would have been booted under the old criteria, albeit with a more expensive premium.

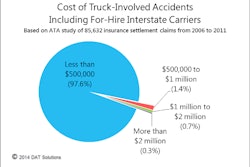

He did also say the company is obviously keeping a close watch on FMCSA’s potential rule to increase the financial responsibility required of carriers and brokers. The minimum is currently at $750,000.

Progressive does not have a stance on the change, Miller says, but much of their book is at a million already, he says, as are the requirements of many shippers. He couldn’t speak to specifics of premium increases that could be associated with an increase.

Trailer skirt discount

The company is also still offering a discount to owner-operators on the purchase and installation of trailer skirts. There are more than 100 Progressive network shops nationwide, Miller says, where the trailer skirts can be bought and installed.

Owner-operators can purchase skirts for $700 and and a $250 installation fee — about a $400-$500 savings off retail prices, Miller says.