Among the largest of variable costs for any trucking business, fuel expense can also be among the most volatile. Understanding how to use as little of it as possible is key to boosting profitability.

Among the largest of variable costs for any trucking business, fuel expense can also be among the most volatile. Understanding how to use as little of it as possible is key to boosting profitability.Revenue is only half of the profit equation. Being able to survive and thrive as a business owner has as much to do with managing costs as it does with generating revenue. Like the chief financial officer of any company, you have to be concerned about rising costs, especially without increases in revenue. But as many owner-operators will tell you, trying to reduce costs, let alone make sense of them, can be a complicated task. Understanding basic principles of operating costs can save you thousands of dollars a year:

A PENNY SAVED IS $1,000 EARNED. The owner-operator who can save just one penny per mile over 100,000 miles driven annually will save $1,000 in a year.

COSTS ARE NOT THE SAME EACH MONTH. If 9,600 miles are driven one month and 10,000 miles the next month, there will be two different sets of costs for each month. For example, if your tractor payment is $1,850 per month and you drive 9,600 miles in the month, your tractor payment will cost you 19.3 cents per mile. However, if you drive 10,000 miles, your tractor payment will cost you 18.5 cents per mile. This is one of your major fixed costs. Fixed costs do not go down over time, but you can reduce your cost per mile by driving more miles. The difference per mile here is only 0.8-cent, which may seem like small change, but remember the “one penny saved” example above. In this example, the difference in fixed cost is $960 per year, which depending on your decisions will stay in your pocket or go out the window

FOR EVERY EXTRA DOLLAR OF REVENUE GENERATED, ONLY PART OF THAT DOLLAR IS PROFIT. But for every extra dollar of cost saved, that entire dollar contributes to your profit.

COSTS CANNOT BE UNDERSTOOD ON A PER-MILE BASIS ALONE. In the example above, the 10,000-mile month results in a lower cost per mile. Also, as the cost per mile was reduced, revenue went up for driving the extra 400 miles – a double benefit per mile.

FIXED AND VARIABLE COSTS

A fixed cost already is determined and does not change from month to month. Any expense defined by time – such as a tractor payment, insurance payment, license fees – is a fixed cost. That cost will be the same every day whether your truck is driven one mile or 600 miles. It is a daily fixed expense and has to be confronted 365 days per year – you are challenged daily to bring in revenue to match against it.

A variable cost is related to how much you drive. Fuel, tires and maintenance are good examples. Most variable costs will be similar for every mile you run. These are the costs for distances traveled and other items that are required to move your truck the distance your load requires. Variable costs are what enable your truck to go down the road

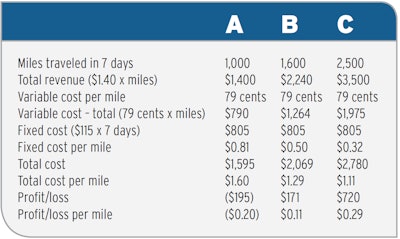

An owner-operator leased to another entity might show a variable cost of 79 cents per mile and a fixed cost of $115 per day. Here is an example of how to apply fixed and variable costs to your business. In this example, assume pay of $1.40 per mile.

In Example A, the operator couldn’t even break even, so there was no money left to pay him for driving or to cover personal expenses. In Example B, the operator is making a meager profit, with a little money to pay him for driving. And in Example C, the successful operator has money left over for savings and retirement after paying all expenses.

Also, note how fixed cost per mile was reduced in the successive examples. The more miles you run, the more you reduce your fixed cost per mile.

WHERE THE MONEY GOES

Keeping track of all costs and their shares of revenue can be helpful in seeing whether any part of your operation is abnormal compared to other operators. This is useful not just for cost cutting but for making business decisions – for example, whether you can afford the $2,500 payment for a new rig.

Based on the averages of clients of ATBS through December 2014, here’s the percentage of total revenue you should expect to spend on key expenses:

- Fuel: 41 percent.

- Truck payment: 15 percent.

- Maintenance: 6.5 percent.

- Insurance: 4 percent, counting physical damage, bobtail and occupational/accident premiums.

- License and permits: 1 percent.

- Cell phones and other communications: 1 percent.

Note that after miscellaneous expenses are figured in, the average ATBS client nets only 33 cents for every dollar of gross revenue, meaning 67 cents of each dollar earned has to go toward vital business expenses. Keep that in mind the next time you’re holding a big settlement check and feel the temptation to go on a spending spree.

On the other hand, if you’re paying yourself much less than a third of your revenue, take a careful look at your records. Chances are one or two costs are out of control, or your revenue is too low.