Health is the third core reason owner-operators fail – behind only poor truck maintenance and a lack of business skills. Many over-the-road drivers rarely have the time even to see a family physician at home, much less a doctor while on the road. Many also lack a disciplined approach to diet and exercise.

Complicating this health picture for many owner-operators is inadequate health insurance coverage. The average owner-operator who spends money on health, dental and vision insurance pays about 8 percent of his average net income.

One bright spot among the high costs is a sizable tax break. Independent contractors can deduct 100 percent of their premiums, provided a spouse doesn’t qualify for health insurance through an employer. Assume you have a family policy with a moderate deductible that costs $10,000 a year in premiums. If you’re in the 15 percent tax bracket, that knocks $1,500 off your bill.

In spite of all the risks, many owner-operators go without health insurance. Today, following implementation of the Affordable Care Act, going without will result in a fine at tax time. The health insurance landscape is changing, and there are ways to get at least a minimal level of health coverage or to reduce costs for good coverage.

Your spouse. If you’re married and your spouse is eligible for family health care coverage, take advantage of it.

Your company. If you’re leased to a carrier, you may be eligible for its group policy, though not in the same way as an employee. You’ll pay all of the premium – the employer’s share plus what an employee would pay – plus a fee for processing. Check with your business services provider to make sure the plan doesn’t endanger your status as an independent contractor.

High deductibles. Policies that charge lower premiums in return for you assuming high deductibles, often $2,000 to $5,000, are helpful if you rarely visit the doctor. After meeting the deductible, the policyholder pays a portion, often 20 percent, of the medical bills. Policies are available with deductibles as high as $10,000. However, if you raise your deductible too high, you’re in effect paying for health care out of your pocket and buying only catastrophic coverage, a safety net to cover ailments that produce five or six-figure bills, such as a heart attack or cancer. If you’re older than 40 with a family history of medical problems, or if you’re someone who is unlikely to use health care on an ongoing basis, you might not want such a high deductible because you would rarely receive benefits.

High-deductible plans, many available via the ACA health-insurance exchanges (see below), then can be associated with a Health Savings Account, which allows you to contribute funds to use on health expenses on a tax-deductible basis. Set up properly, such a plan can give an owner-operator the advantage of paying all medical expenses with pre-tax dollars.

ACA health-insurance exchanges. For owner-operators in certain situations, the Affordable Care Act has solved some health care financing problems. It also creates an unprecedented health care financing problem – fines – for those who want no part of health insurance.

Premiums available on the new health-insurance exchanges vary widely by plan level, family size, age, income-based tax credits and where you live. The lower an operator’s taxable income is, the better rates look in the exchanges.

There are two primary ways to shop for coverage – doing it yourself or working through your insurance company or insurance agent/broker. As you shop, know that under the ACA, unlike previous insurance-industry common practice, you cannot be denied coverage on the basis of a pre-existing condition such as diabetes or history of a heart attack. What you’ll need:

•Most recent tax returns and estimated taxes for both you and (if applicable) your spouse. To determine whether you’ll qualify for reduced premiums, you’ll need to estimate your next year’s Modified Adjusted Gross Income as accurately as possible, a fairly easy task for W-2 salaried employees but not always so for owner-operators. Overestimate your income, and you may get premium dollars back come tax time the following year. Underestimate, and the opposite is true.

•Details on household size and any employer-based insurance available to a spouse. If you have access to that insurance, you will not qualify for reduced premiums on the exchanges unless the out-of-pocket cost for employer premiums exceeds 9.5 percent of household income.

Doing it yourself.

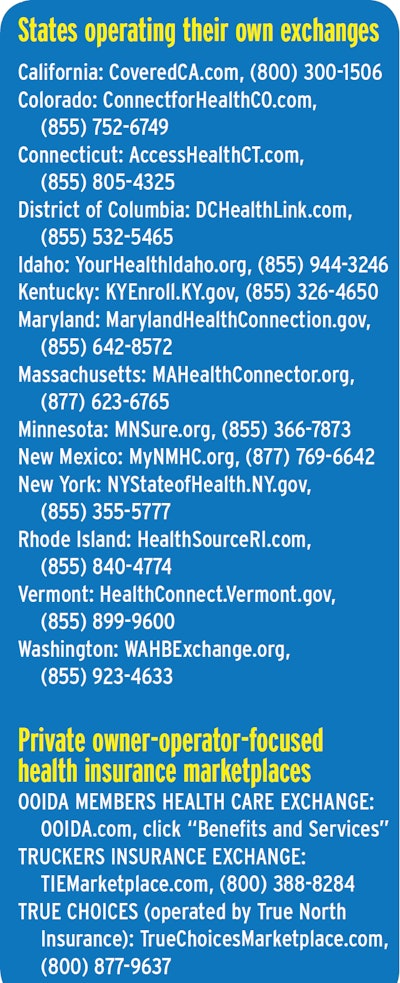

Start an application online. You’ll need a working email address. Start by following links to the individual portion of the website you’re using, whether HealthCare.gov or your state of residence’s website (refer to the map/list on this page to determine).

•Create an account with a username and password – and answers to security questions.

•Go through the lengthy process. Both federal and state online marketplaces will guide you through the entire three-tier process. 1) Select an agent if you want to use one for advice. Decline if you don’t. 2) Fill out a lengthy application to determine whether you qualify for tax credits. 3) Compare plans and apply for insurance, paying the first month’s premium.

Start an application by phone. Refer to the map/listings in this chapter for your state’s primary application contact phone number. The process will follow steps similar to those detailed above.

Use an agent or broker, or insurance company. Independent health insurance brokers’ standard line on their usefulness is that, given they work on commissions collected from insurance companies and not from clients, you don’t pay any more whether you use them or book your own insurance yourself. The key to using a broker under the Affordable Care Act is determining whether the broker is licensed to sell from the exchanges in your state of residence. That can be resolved through a web search of the broker’s business name or a call to ask a question. Brokers understand the intricacies of how deductibles work, as well as the variety of options available on the exchanges among the standard plan levels.

Coverage levels available

Preventive services are covered in all exchange plans except those for catastrophic coverage. Those low-cost plans kick in only after a high annual deductible is met. Any non-preventive medical care costs would be split between the insurer and insured at coinsured percentage rates specified in the different plan levels after any deductible is met.

A big part of the Affordable Care Act is the standardization of plan levels, with variations. For instance, there are PPOs and HMOs, the latter more limited in doctor options but generally cheaper. There are plans with varying deductibles at each standard level, and many set up to pair with a Health Savings Account for medical spending. Given that access to tax credits to reduce premiums is based on your income, and money put into an HSA directly reduces your taxable income, use of such a plan could be beneficial to overall premium costs if your household income is near the level at which you might qualify for premium reduction.

The subsidy line is drawn at 400 percent of the federal poverty level; in 2016 that was $47,080 for an individual, $63,720 for a family of two, $80,360 for three and $97,000 for four. If your household modified adjusted gross income is below that level and no employer-based insurance is in reach, you will qualify for reduced premiums. Standardized-plan coinsurance levels are as follows:

Platinum plans: 90/10 percent

Gold plans: 80/20 percent

Silver plans: 70/30 percent

Bronze plans: 60/40 percent

Catastrophic coverage: Available on the exchanges only for applicants under age 30

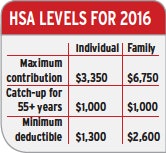

For some owner-operators, tax-exempt medical accounts can lessen the hurt of health-care costs. Health Savings Accounts are part of many plans on the new health-insurance exchanges and allow unspent contributions to roll over year to year. The major qualifier remains having a policy with a high deductible. Of course, this is also the root of the savings, because premiums on such policies tend to be lower. A high deductible means you’re likely to pay 100 percent of your routine health care; should anyone on your policy need major care, the policy kicks in after the deductible is met.

Advantages include:

- A wide range of qualifying expenses, including chiropractic services, over-the-counter pain relievers and other items that traditional insurance wouldn’t approve.

- Some health care providers discount services for their HSA clients.

- Your taxable income is reduced by whatever you put into the HSA. And unlike money put into an IRA, which gets taxed upon withdrawal, HSA funds are never taxed if they’re spent on health (though there is a 20 percent penalty for funds not used on health). After you turn 65, you can use the savings on things unrelated to health, but such spending is taxable.

Health Reimbursement Arrangements

Some owner-operators are able to take advantage of Section 105 of the federal tax code, which allows for Health Reimbursement Arrangements. A sole proprietor owner-operator who can establish a legitimate employer-employee relationship with his or her spouse, whether team driving or not, can set up an employer-funded spending account from which to pay medical bills for both people. The entire amount can be noted on Schedule C as a business deduction, rather than as a line item on your 1040. This produces tax savings higher than the standard medical premium deduction for the self-employed.

Some companies set up HRAs for a fee, or you can set up such a plan yourself, using software and guides available online.

Here’s how an HRA works. Suppose an owner-operator employs her husband as a part-time bookkeeper, paying him a wage and a health benefit. The couple averaged $14,200 in yearly insurance premiums and other medical expenses for the past three years. Through their HRA, that entire amount has been deductible as a business expense, meaning it’s not subject to self-employment and income tax, which saves them on average $4,303 a year in taxes – and more if they’re subject to a state income tax.

Without the couple’s HRA, $10,000 in health insurance premiums would have been exempted from federal tax but not self-employment tax (typically 15.3 percent, but reduced in 2011-12). The remaining medical costs could be claimed under personal income taxes, but their leftover $4,200 does not exceed the threshold of 7.5 percent of total income and the standard deduction.

In the end, the HRA helps the couple save $2,803 more than the typical health care deduction.

With an HRA

Insurance premium expenses $10,000

Other medical expenses + $4,200

Total medical expenses = $14,200

Foregone federal income tax ($14,200 x 15%) = $2,130

Foregone self-employment tax ($14,200 x 15.3%) = + $2,173

TOTAL SAVINGS = $4,303

Without an HRA

Insurance premium expenses $10,000

Foregone federal income tax: x 15%

TOTAL SAVINGS = $1,500

Tips for the short haul

Caring for your body is like caring for your truck in that both involve assessing products and services. The informed consumer knows how to get the best value. In the realm of health care, finding those values isn’t always obvious. Here are ways to spend your health dollars wisely.

Shop around. Ask different offices how much they charge for similar medical or dental services. While the cheapest may not always be the best, three or four contacts should give you a good estimate. Consumersunion.org reports that stores in the same city often have widely different prices for the same medications. Call and ask. You also can buy your meds online.

Buy generic. By law, U.S.-made generic medicines are required to meet the same standards as their brand-name inspirations, but they’re far cheaper.

Review all medical bills. You’ve probably asked questions about line items when reviewing a truck purchase statement. The same policy applies to medical bills. Even a simple visit to the doctor can produce multiple charges from a lab or X-ray technician, and an emergency room visit or surgery can produce a stream of bills for months. Carefully review any medical bill before paying it. This especially is important if you don’t have an insurance company to vet charges on your behalf. If items are listed as “miscellaneous” or coded, ask for details. Scrutinize statements from your insurer just as carefully.

Negotiate rates. The National Insurance Resource Center’s website suggests that negotiation may work for people without insurance in getting medical expenses reduced before the service is rendered. It never hurts to ask.

Get a second opinion. If your doctor or dentist suggests a major operation or procedure, get another opinion. Some insurance policies require a second opinion for major procedures, so you could be liable for a big bill if you fail to do so.

Appeal insurance rejections. Most insurance companies have an appeals process if a billed procedure or medical expense is denied. Most insurance companies allow for three appeals on a single issue.

Avoid emergency rooms. If you’re suffering a heart attack or serious injury, use a hospital emergency room. Otherwise, they’re too expensive and often have long waits. Many communities have walk-in clinics that treat common problems such as colds, flu, broken limbs and cuts.

Use telemedicine services. Although the concept of “telemedicine” originated 40 years ago, it’s just now becoming a reality. The appeal to truckers is twofold: low cost and easy access. Sites such as MDLive.com offer physician “visits” for $49 or less. MDLive also offers behavioral services, with immediate access to therapists and mental health professionals. While these services shouldn’t be used for your overall health care, it’s nice to know you can get a quick consult without having to shut down somewhere accessible to a doctor’s office. Finding a pharmacy may be another hurdle, but at least you could arrange for meds at a convenient exit.

Keep up with tax-deductible expenses. Many medical-related items are tax-deductible, including doctor and dentist fees, false teeth, prescription eyeglasses, laser eye surgery, hearing aids and crutches. Such expenditures are deductible only in excess of 7.5 percent of the taxpayer’s adjusted gross income. Unless you have a lot of expenses, it is difficult to gain a real advantage in medical expense deductions. And don’t create headaches for your tax preparer by mixing in receipts for drugs or medical services for which you’ve already been reimbursed through your insurer. Check with your tax preparer for details, or visit www.irs.gov/taxtopics and go to topic 502 for more details.

Tips for the long haul

Preventive maintenance works. The more you keep your body in shape, the less downtime you’ll experience, and the less you’ll spend getting yourself fixed. These best practices will, over time, prevent you from spinning your wheels in the doctor’s waiting room instead of keeping them turning on the road.

Get regular exercise. Some things you can do in your cab, such as sit-ups, jumping jacks and stretches. Walk – or jog, if you can – around the truck stop lot. Whatever level you’re capable of, try to exercise four or five times a week.

Eat healthy. Stay away from the fast food and grease common in truck stop diners and on fast food menus. While an occasional moderate indulgence is OK, try to mix in more low-fat meals – heavy on salads, vegetables and fruits. Most truck stops now offer such choices.

Drink more water. Too many people reach for a Mountain Dew when they become dehydrated. But soft drinks, as well as beer and other alcoholic beverages, can dehydrate you further. Instead, reach for a large glass of water.

Shun tobacco products. They’re life-threatening. The sooner you quit, the better.

Don’t be a substance abuser. Trucking is a hard job, but if you’re relying on heavy drinking to “unwind,” you’re kidding yourself. The same goes for using illegal drugs or abusing prescription medication.

Get an annual physical. It’s critical for drivers to be checked out at least annually. Your U.S. Department of Transportation-mandated physical is not the equivalent of an annual physical from a doctor. You should be screened for sleep apnea; eye disease; colorectal, prostate or skin cancers; excess cholesterol; and high blood pressure.

Ensure your records are accessible. If you get sick on the road, call your family physician or dentist to have medical files and X-rays forwarded by fax or email to an on-the-road clinic. Several companies offer services that store your medical information on USB jump drives or scrolls that can be carried on a key chain. MedicAlert and American Medical ID offer medical jewelry to be worn as a necklace or bracelet for those with severe conditions, such as an allergy to penicillin.

Follow doctor’s orders. Whether it relates to special diet, daily exercise, sleep or medication, it’s critical to stick with a prescribed regimen.

Avoid paying by credit card. Unless you’re paying off your entire balance every month and know that you can do the same with additional medical costs, stay away from credit. If your account charges 18 to 20 percent, even a $2,000 bill that takes months to pay could cost hundreds of dollars more before you’re done. Pay in cash, use savings, or set up a payment plan with the provider’s office.

Don’t forget your teeth. Brush and floss regularly. Lay off artificial sweeteners and sodas. Small dental problems can grow into major health problems in time.

Know your body’s limits. Don’t hurt yourself with a pulled muscle, joint or other injury by lifting or reaching for an item that is out of your range. This rule applies not only to securing a flatbed load or wrestling cargo out of your van, but also to home projects such as climbing ladders.

Know your medical history. If one side of the family has heart problems, pay careful attention to the way you treat your heart. Attend likewise to family histories of high blood pressure, diabetes, cancer, allergies, etc.

Income replacement insurance

The probability of an income-interrupting event is more likely than you might think. Three out of every 10 Americans between ages 35 and 65 will become disabled for more than 90 days at some point in their lives, according to the American Council of Life Insurers. One in seven will become disabled for more than five years.

An owner-operator working without adequate income replacement coverage who experiences an on-the-job injury can be exposed to various hardships, including loss of income if unable to work. Any given plan will pay a percentage of your income with a flat rate maximum and only for a fixed period. The typical payout is 50 to 60 percent with a cap, though some may run up to 70 percent. Most policies will stay in effect as long as you stay current on your premiums, even if chronic health problems continue after your initial claim.

Occupational accident and disability policies, and in certain circumstances Social Security disability, are the most common income replacements available to owner-operators.

Occupational accident. Usually the most inexpensive coverage for owner-operators is an occ/acc policy. It provides benefits to the policyholder in the case of a work-related injury or illness, unlike a traditional accident policy that pays out even if the accident is not work-related. Benefits are not based on income, but rather a menu that outlines the payment amounts for minor to major job-related injuries or illnesses. Some carry options or riders depending on what the policyholder wants.

Most fleets require leased owner-operators to obtain either workers’ comp or occ/acc coverage. For this reason, many owner-operators don’t view occ/acc as elective coverage. One thing that makes occ/acc the top choice is it’s usually cheaper than workers’ comp. Also, in most states, workers’ comp won’t pay out to self-employed workers. This makes occ/acc an easy choice if your state’s workers’ comp regulations have an opt-out provision.

Take a good look at the insurance company itself before deciding on a particular policy. Look for favorable financial ratings from a rating agency such as A.M. Best.

Disability. Disability insurance is offered with short-term and long-term plans that normally cover accident and illness whether they are job-related or not. Short-term disability typically will provide benefits for up to 26 weeks based on a percentage of income, with a fixed cap. Long-term policies take over where short-term policies leave off and usually pay benefits for two to five years, but can continue up to age 65 when Social Security and personal retirement savings normally begin.

When it comes to the definition of disability, there two distinct types: own occupation or any occupation. The former means the disabling event occurred while on the job you had – in your case, driving a truck – and that it left you unable to perform your former job.

Any occupation disability means that if you are able to perform another job, you are not disabled. Your normal income is not taken into consideration. If you can be trained to work at another job – even at minimum wage – you probably won’t be able to collect benefits.

True own-occupation disability has become harder to find. It’s generally expensive, especially for occupations like trucking that are deemed high-risk. Word of caution: Some policies that claim to be own-occupation have qualifiers that make them any-occupation, so pay attention to the fine print.

Qualifying for disability

Shop for a disability policy on the individual market, and you’ll usually have to qualify. Factors such as age and overall health will determine how much you pay. You may be required to pass a basic physical to determine any existing or potential physical problem. The better shape you are in, the lower the premium. Buying into a group policy, such as those administered through membership organizations like OOIDA, may offer less-stringent requirements and lower premiums. It is likely that you will have to declare pre-existing conditions, which could mean no coverage for the first year.

Social Security. If you become unable to work for more than 12 months, Social Security Disability Insurance may be an option. SSDI is not based on income; a person can qualify for SSDI if he or she is younger than 65 and meets these criteria:

- A physical or mental condition prevents the individual from engaging in any “substantial gainful activity.”

- The condition is expected to last at least 12 months or result in death.

- The person has accumulated 20 Social Security credits (credits are based on your earnings with a cap of four credits per year) in the past 10 years prior to the onset of disability (normally four credits per full or partial year); one additional credit is required for every year by which the worker’s age exceeds 42.

This is not an easy option to pursue: The filing process takes about four months, and the Social Security Administration denies about 60 percent of the initial claims. If you are approved, you have to wait five months for the first check.

Other Resources. Don’t spend so much money on income-replacement insurance that you starve your emergency or retirement fund. Remember, you’ll need that retirement money whatever happens, whereas you may never need the income-replacement benefits. If you have plenty of savings and are at a late stage in your career – maybe already beginning to cut back on your workload – you may not need income-replacement insurance at all. Since six months of living expenses is relatively easy for a disciplined saver to sock away into some account or another – savings, checking, money market – long-term disability policies may be better investments than short-term ones.