The number of spot truckload freight posts jumped 18 percent during the week ending Jan. 5, outpacing the 11 percent gain in the number of truck posts, said DAT Solutions, which operates the DAT network of load boards.

The tighter capacity led to a 3-cent increase in national average spot rates for dry van, reefer, and flatbed freight. The upward trend may be brief: the price of fuel (along with surcharge amounts) continues to fall, and rates have been weaker on high-traffic lanes.

National average load-to-truck ratios

Capacity imbalance produced big gains in national average load-to-truck ratios for flatbed, though reefer and van were stable or unchanged:

*Van: 8.9, unchanged

*Flatbed: 33.7, up 29 percent

*Reefer: 9.8, down 7 percent

National average spot rates

For the second straight week, spot rates increased for all three equipment types, though slightly, and demand indicators could spell little movement in vans and reefers this week:

*Van: $2.11/mile, up 1 cent

*Flatbed: $2.46/mile, up 1 cent

*Reefer: $2.47/mile, up 2 cents

Rates increased despite a 3-cent decline in the price of diesel to $3.05/gallon. Spot rates include a calculated surcharge.

Trend to watch: Beer!

Rates moved higher on just 41 of DAT’s top 100 van lanes last week. But the three largest lane-rate increases were out of Denver, with some lanes better than usual out of the tough market:

Denver to Albuquerque jumped 28 cents to $2.35/mile.

Denver to Oklahoma City gained 21 cents to $1.41/mile.

Denver to Chicago added 20 cents to $1.52/mile.

Denver is a big beer-producing market, with large-production breweries and craft brewers shipping beer in vans and reefers. It’s possible NFL playoff and college bowl games during the first week of the year increased demand from bars, restaurants and grocery stores. (As a side-note, Mission Foods has a tortilla-chip processing facility in Pueblo, Colorado.)

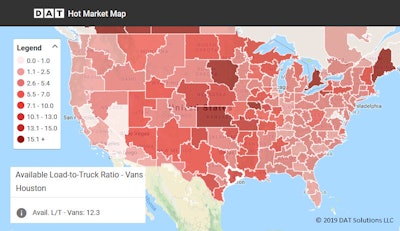

Market to watch: Houston vans

We always watch Houston for spot flatbed freight, given its ties to oil and gas.

Houston spot van freight indicates activity in energy and imported goods. When Houston is humming, so are the rest of us. It’s a market to watch over the next several months.

Houston spot van freight indicates activity in energy and imported goods. When Houston is humming, so are the rest of us. It’s a market to watch over the next several months.But Houston is also a top van market. Nationally, van load and truck posts both increased 11 percent compared to the previous week and spot rates were down in many major markets. But the average outbound spot van rate was unchanged in Houston ($1.87/mile), and is up 2 percent over the last four weeks. That may not sound like much, but it’s one of the few positive movers during that time. Its load-to-truck ratio remains well elevated above the national average, too, which could translate to better negotiating leverage if it sticks or gets better.