An increase in the minimum amount of liability required for trucking companies would adversely affect owner-operators and smaller carriers at a disproportionate rate and may even force them to close shop, according to recent analysis from DAT Solutions.

The analysis comes in response to FMCSA’s recent grappling with upping the current $750,000 minimum. The agency published an Advanced Notice of Proposed Rulemaking last month asking carriers for input on a potential increase. (It posted 26 questions it hopes to receive answers to from carriers — Click here to read more on the questions and how you can offer your input on the increase.)

DAT’s Don Thornton, senior vice president of sales and business development for the company, wrote in a blog post published last week that smaller carriers like owner-operators generally don’t have the option to self-insure the way some larger carriers do. An increase to the current liability minimum and any subsequent premium increases would have to be covered directly out of pocket, Thornton writes.

Moreover, as freight increases and trucking’s capacity struggles to keep up with shippers’ need for trucks, an increase in insurance premiums would only further inhibit the industry’s ability to add trucks and grow capacity, Thornton writes.

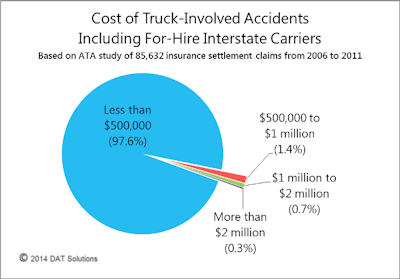

Given the capacity problems and research showing that only a small fraction of truck-involved crashes exceed $500,000 in claims — let alone the $750,000 minimum — an increase in liability insurance requirements simply doesn’t stack up in a cost-benefit analysis, Thornton says.

He also posted this graphic, put together from data from ATA, hammering home that point:

Click here to read Thornton’s full blog post.