Broadly speaking, spot market rates were up last week on DAT Load Boards following the previous month’s volume increases. Volumes fell last week, however, no doubt due to Hurricane Matthew as load posts dropped at the end of the week.

Reefer load posts spiked in Charlotte last week ahead of the hurricane. Lots of those loads were heading to Atlanta and Florida. Otherwise, reefer trends were all over the place. Volumes were down nationally, and more than half of the top 72 reefer lanes saw rates fall. However, the national average reefer rate added 1 cent to $1.92/mile.

Reefer load posts spiked in Charlotte last week ahead of the hurricane. Lots of those loads were heading to Atlanta and Florida. Otherwise, reefer trends were all over the place. Volumes were down nationally, and more than half of the top 72 reefer lanes saw rates fall. However, the national average reefer rate added 1 cent to $1.92/mile.

Rates and volumes held steady for vans out of Chicago and Atlanta, which were numbers two and three for load posts, but demand was way down in Texas.

Rates and volumes held steady for vans out of Chicago and Atlanta, which were numbers two and three for load posts, but demand was way down in Texas.The impact of the Hanjin bankruptcy continued, boosting demand for trucks on the West Coast. Los Angeles was the top market for van load posts again last week, and by a large margin. Rates are still elevated on long-haul lanes heading east from L.A., due to the bankruptcy fallout. The average rate on the cross-country trip from L.A. to Elizabeth, N.J., hit $1.74/mile.

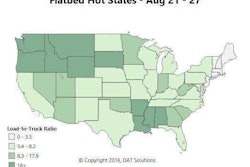

The national average rate for flatbeds moved 4 cents up to $1.92 per mile, though the load-to-truck ratio declined 7 percent. The demand indicator was strongest for flatbeds at origin points between the Pacific Northwest and the Dakotas. Another hot spot was seen in the Southern states of Alabama, Mississippi, Louisiana and Arkansas, a bit of a shift from the flatbed picture from the last segment update. Compare this map to that one, from early September, via this link.

The national average rate for flatbeds moved 4 cents up to $1.92 per mile, though the load-to-truck ratio declined 7 percent. The demand indicator was strongest for flatbeds at origin points between the Pacific Northwest and the Dakotas. Another hot spot was seen in the Southern states of Alabama, Mississippi, Louisiana and Arkansas, a bit of a shift from the flatbed picture from the last segment update. Compare this map to that one, from early September, via this link.