The stat in the headline doesn’t tell the whole story, however, as DAT’s Ken Harper noted with the charts for this week’s spot freight update: “Rates are basically flat from where they’ve been the past few weeks,” Harper notes, at a seasonal bottom for reefers and vans, flats too to an extent. A couple potential answers for the anomaly continue to be that a flood of trucks from larger contract carriers onto the spot market has been more than enough capacity to cover the boost in freight.

“The other factor,” Harper says, “is that reefers aren’t generally in great demand, so they’re competing with vans for the freight that’s on the load boards.”

If freight continues to climb, however, there will most certainly be upward pressure on rates, Harper adds. And “on the bright side, if you’re running flatbeds, freight and rates are up about a month ahead of schedule.”

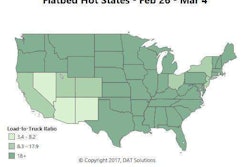

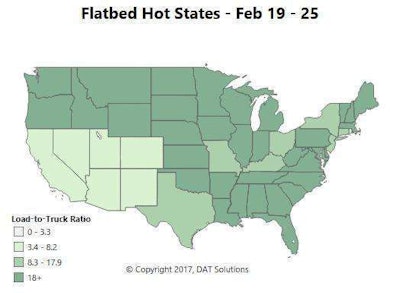

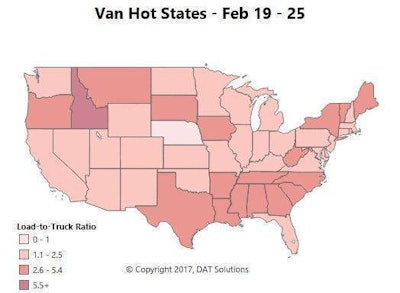

Higher volumes in the Southeast and Northeast have been driving much of the action. A lot of lanes have been up-and-down as of late, though, depending on weather changes. For these demand maps, as is usual in these reports, darker colors represent higher load-to-truck ratios and better negotiating strength for carriers on average.

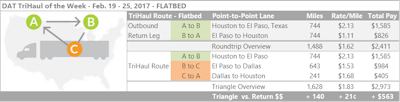

Higher volumes in the Southeast and Northeast have been driving much of the action. A lot of lanes have been up-and-down as of late, though, depending on weather changes. For these demand maps, as is usual in these reports, darker colors represent higher load-to-truck ratios and better negotiating strength for carriers on average.Hot markets: Higher volumes on a couple of lanes associated with oil production have also been key to flatbed’s relative strength in February: Pittsburgh to Houston, and Houston to El Paso, Texas. The El Paso market includes the Permian Basin, where there’s drilling activity. Outbound flatbed average rates in Pittsburgh have also surged 28 percent in February.

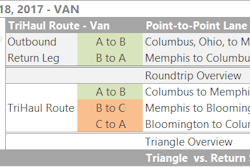

While Houston to El Paso is strong, the increased demand at the destination has pushed outbound average rates from El Paso down significantly for flats, as illustrated in the chart. Breaking up the return to Houston with two loads — stopping over in Dallas for a drop and reload — according to last week’s average would bring up the total trip’s revenue per mile by 20 cents, a significant percentage. If hours are an issue, you might look into going to Austin instead of Dallas, which is a shorter roundtrip.

While Houston to El Paso is strong, the increased demand at the destination has pushed outbound average rates from El Paso down significantly for flats, as illustrated in the chart. Breaking up the return to Houston with two loads — stopping over in Dallas for a drop and reload — according to last week’s average would bring up the total trip’s revenue per mile by 20 cents, a significant percentage. If hours are an issue, you might look into going to Austin instead of Dallas, which is a shorter roundtrip.Not so hot: There’s still a lot of competition for flatbed loads in California, and rates have trended down in Los Angeles for the past month. Rates were also down out of Jacksonville and Savannah, Ga. All three are port cities, so lower outbound rates could be a sign of stronger exports than imports.

A couple weeks ago we talked about how it looked like van rates had found the bottom, but there hasn’t been a significant rebound yet. The national average held steady at $1.62/mile last week after several weeks of steady decline, but volumes continue to improve on the top 100 van lanes. The growing number of van loads is likely to soon put pressure on rates to go up.

A couple weeks ago we talked about how it looked like van rates had found the bottom, but there hasn’t been a significant rebound yet. The national average held steady at $1.62/mile last week after several weeks of steady decline, but volumes continue to improve on the top 100 van lanes. The growing number of van loads is likely to soon put pressure on rates to go up.Hot markets: Van demand has gotten stronger in the South, with load counts rising in Atlanta and Memphis. Volumes have also improved out of Chicago, but there are still enough available trucks in the area to keep Illinois from turning dark red in the Hot States Map above. None of the major van markets saw a significant increase in outbound rates, but these markets should hopefully start to improve soon.

Not so hot: Volumes dropped off in Allentown, Pa., after getting a big boost the week before. And while there were more van loads available out of Chicago, there wasn’t on the lane to Buffalo. The average rate on that lane tumbled 31 cents to an average of $2.12/mile. Out West, things are still mostly quiet, but there otherwise was a lot of movement price-wise last week.