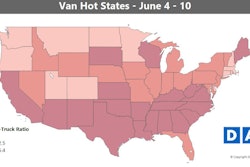

This week’s spot market demand update sees capacity loosening up a bit — truck posts growing on DAT load boards, notes company rep Ken Harper. However, “volumes remained high, so we still have the highest van load-to-truck ratio in years” and average “van rates are still looking good” by comparison to recent months and years.

Getting closer to the end of the month however, “and a weird Fourth of July on a Tuesday,” says Harper, it’s “questionable how long the rates will hold up.”

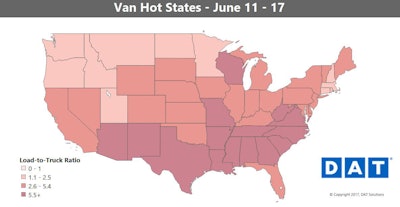

The glow of momentum for van freight faded last week in some areas.

The glow of momentum for van freight faded last week in some areas.Hot markets: Atlanta and Los Angeles have been leading the way in terms of rising rates and volumes. Seattle rates had been falling, but there was a sharp uptick in volumes that pushed prices back up last week.

Not so hot: There were still more rising lanes than falling ones on the 100 highest-volume van lanes, but the gap closed, as prices fell on 40 out of 100. Average outbound rates lost traction from Allentown, Pa., and Denver, due partly to a change in the mix of long-haul versus short-haul loads.

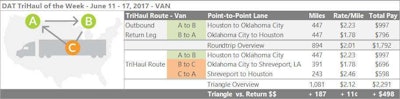

The average rate on the lane between Houston and Oklahoma City has been seesawing up and down for months. When rates are down, think about splitting the return leg. Based on average rates from the past week, you’ll boost your bottom line by nearly $500, with only 180 additional loaded miles. The average rate from Oklahoma City to Houston was $1.78 per mile last week, but you can take a load to Shreveport, La., instead. That lane also paid $1.78, but it positions you to take a second load from Shreveport to Houston, where rates averaged $2.46 per mile last week, and they’re trending up even further now. This might not be worth the time and effort on weeks when the Houston to OKC leg is paying a higher rate, so check out the details before you plan your route.

The average rate on the lane between Houston and Oklahoma City has been seesawing up and down for months. When rates are down, think about splitting the return leg. Based on average rates from the past week, you’ll boost your bottom line by nearly $500, with only 180 additional loaded miles. The average rate from Oklahoma City to Houston was $1.78 per mile last week, but you can take a load to Shreveport, La., instead. That lane also paid $1.78, but it positions you to take a second load from Shreveport to Houston, where rates averaged $2.46 per mile last week, and they’re trending up even further now. This might not be worth the time and effort on weeks when the Houston to OKC leg is paying a higher rate, so check out the details before you plan your route.

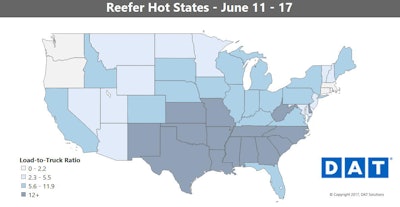

Reefer overview: The national average reefer rate was unchanged at $2.11 per mile last week, the highest average in almost two years. Momentum slowed in major reefer markets and lanes, however. On the top 72 reefer lanes, only 27 had higher rates, a surprising result for mid-June.

Hot markets: Outbound rates moved higher in Los Angeles last week, gaining an average of 8 cents per mile. Freight volume increased out of Atlanta, boosting rates by 4 cents.

Not so hot: Miami and Lakeland, Fla., continue to slip into an off-season lull, and the downward trend accelerated due to wildfires and lackluster harvests. Volumes were also disappointing in two key California produce markets last week: Fresno and Ontario. California vegetable shipments in May were the strongest they’ve been since 2013, however, so outbound volume from the Golden State may yet achieve pre-drought levels. The border markets of Nogales, Ariz., and McAllen, Texas, also hit a speed bump last week, as did Grand Rapids, Mich., and Green Bay, Wis.