“National average rates for vans, reefers and flats continue to hold at two-year highs,” says DAT’s Ken Harper attendant to this spot market demand update, based on load posts, truck posts and average spot rates on loads moved from DAT Load Boards. Those two-year highs mark “the third week in a row rates have been at these levels.”

Given it’s the end of June and the end of the second quarter of the year (when freight typically rises in volume as shippers move inventory) and we’re headed into a four-day-ish Fourth of July, “we expect rates to go even higher as shippers move inventory and retailers make sure store shelves are stocked,” Harper adds.

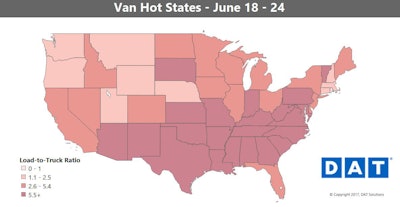

For van, generally, last week Atlanta, Charlotte, and Memphis each added a dime per mile to their already high average van rates for outbound freight, Harper notes, and “this week St. Louis and Laredo look like the places to be regardless of equipment type: thousands of loads and many fewer trucks.”

As for reefers …

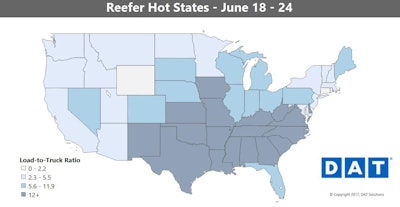

It was “a bit of a surprise that Georgia surpassed Texas and California, respectively, at the leading state for reefer freight” this past week, Harper says. The produce grown in southern Georgia is moved out of refrigerated warehouses and food processing plants in the Atlanta area.

It was “a bit of a surprise that Georgia surpassed Texas and California, respectively, at the leading state for reefer freight” this past week, Harper says. The produce grown in southern Georgia is moved out of refrigerated warehouses and food processing plants in the Atlanta area.Reefer overview: Reefer rates also regained some momentum last week. Rates rose in 41 of the top 72 lanes, compared to only 27 in the previous week.

Hot markets: Fresno’s outbound volumes and rates improved, and the same was true for Chicago and Philadelphia. The surprise was an increase in freight volume out of Miami, probably due to imports. As noted above, Atlanta was a hot market for reefers as well as vans last week, thanks to all the seasonal produce leaving refrigerated warehouses and food processing plants. A lot of that produce originates in the Tifton and Macon markets in Southern Georgia, and is distributed out of Atlanta.

Not so hot: Outbound rates lost traction from two markets near the Mexican border. McAllen, Texas, rates lost an average of 11 cents per mile, and Nogales, Ariz., dropped 16 cents.

Some rough weather last week disrupted some freight movements in the South. So rate averages have held steady for vans, even though fuel surcharges are on the decline.

Some rough weather last week disrupted some freight movements in the South. So rate averages have held steady for vans, even though fuel surcharges are on the decline.Van overview: Freight volume continues to be strong for vans, and rates are a full 10 cents higher than the average for May, and they may go up again this week.

Good things come to those who wait. Friday is the end of the quarter, and it’s also the last weekday before July 4, so many shippers will feel extra pressure to move those last-minute loads this week.

Hot markets: Outbound rates rose by about 10 cents per mile last week in Atlanta, Charlotte and Memphis, while Dallas rates added an average of 5 cents per mile. Storms and flooding played a big role. Rates also rose, if less dramatically, out of Chicago (up 4 cents) and Allentown (up 3 cents), which is a positive sign. As noted by Harper up top, this week the hot markets are St. Louis and Laredo, with thousands of load posts per day and a shortage of available trucks, for all trailer types.