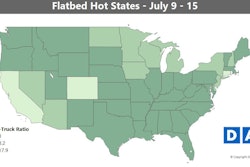

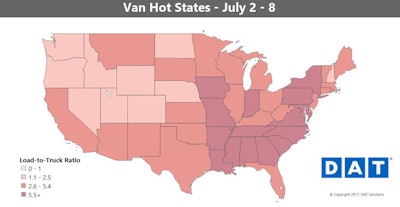

The spot market last week saw lower load volumes than in recent weeks on DAT load boards, notes the company’s Ken Harper, mostly given the Fourth of July landed on a Tuesday this year. Lots of people also took Monday off, of course, all around the country. But even though volumes were down, rates for vans went up in Northeast, spurred by retail trade and consumer goods moving into place for Amazon’s Prime Day sales.

And “although freight volumes were down” all around, Harper says, “the national average rates for vans, reefers and flats were up by a dime, a nickel and a nickel respectively.”

May and June, generally, he adds, were good months for freight and rates, both at two-year highs, “the question is: how long will this last, since July is usually when the summer doldrums hit. So far, this week, both freight and rates are looking strong.”

Van hot markets: The shipments of consumer goods led to higher rates out of Philadelphia; Buffalo, N.Y.; and Allentown, Pa., where there are distribution centers that serve the most densely populated parts of the country. Rates also rose on inbound lanes like Columbus, Ohio, to Allentown and Charlotte to Buffalo.

Not so hot: Most other major van markets were down slightly, though spot rates in many areas remain the highest they’ve been in two years. Low oil prices may have decelerated things in Texas, with rates falling on some high-traffic lanes out of Dallas and Houston.

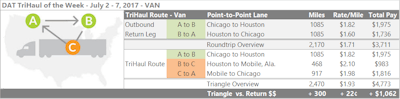

This week, Harper notes, DAT launched a new version of the DAT TruckersEdge load board, TruckersEdge Pro, which includes the company’s “TriHaul” tool, offering quick looks at load options around low-average-rate lanes. It also lets you see the average lane rate for the past 15 days. So if you’re searching for loads on a lane out of Chicago to Houston and the rate coming back isn’t looking great, it’s simple to view potential triangulation options that might fit into your timing. In this example, an extra drop and pick in Mobile, Ala., would add 300 miles, but it could also boost revenue more than $1,000 and push the average rate per loaded mile up from $1.71 to $1.93, based on the averages. Splitting would also work with New Orleans as a center point, judging by the averages, instead of Mobile, with fewer miles but also slightly lower rates.

This week, Harper notes, DAT launched a new version of the DAT TruckersEdge load board, TruckersEdge Pro, which includes the company’s “TriHaul” tool, offering quick looks at load options around low-average-rate lanes. It also lets you see the average lane rate for the past 15 days. So if you’re searching for loads on a lane out of Chicago to Houston and the rate coming back isn’t looking great, it’s simple to view potential triangulation options that might fit into your timing. In this example, an extra drop and pick in Mobile, Ala., would add 300 miles, but it could also boost revenue more than $1,000 and push the average rate per loaded mile up from $1.71 to $1.93, based on the averages. Splitting would also work with New Orleans as a center point, judging by the averages, instead of Mobile, with fewer miles but also slightly lower rates.

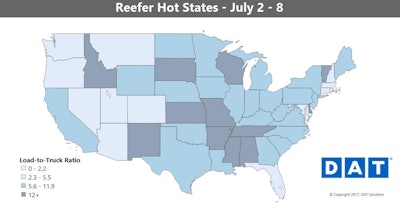

Reefer overview: Reefer volumes didn’t slip as much as vans during the short work week with strong demand on shorter hauls. Shipments for the top 10 fruits and vegetables out of California were down slightly in June compared to May, but the July forecast remains strong.

Hot markets: The biggest increases in reefer rates last week were on lanes under 450 miles. The average rate from Dallas to Houston rose 37 cents, while reefer loads going from Northern New Jersey to Boston paid 21 cents better per mile on average. Midwest volumes are also building, which boosted regional lanes out of Chicago and Grand Rapids, Mich.

Not so hot: In general, longer lanes paid less last week, and prices tumbled big time out of Central Florida. The stronger volumes in the Midwest also led to some re-balancing on lanes like Atlanta to Chicago, which was down 34 cents to an average of $1.88 per mile.

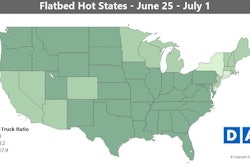

Last week’s report: