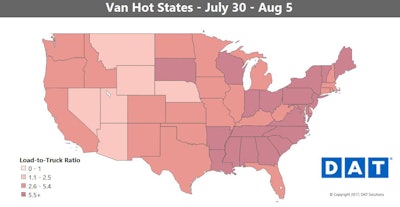

DAT’s Ken Harper was a little wound-up in his note to me with this week’s demand maps and charts from the company’s load board data. “Here’s one for the record books: August started stronger for vans than any of the last 18 months,” he said. “August! Really? What happened to the summer doldrums” typical for freight and rates this time of year as markets cool down after the Spring freight season?

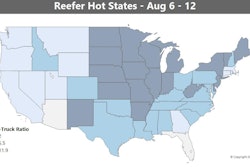

Good news for owner-ops: Those doldrums have yet to materialize in any segment, really. Owner-operator Randy Carlson, in yesterday’s Overdrive Radio podcast, notes that with his reefer, he’s seeing demand running high around Minnesota, Wisconsin, Indiana, Nebraska and elsewhere in the Midwest, with trucks tight. “The spot freight is really good right now,” he said, not so during the first quarter. “Rates are really good, and trucks are tight,” a good mix for more as long as the economy keeps moving.

Retail/back-to-school freight demand to the Northeast appears to be driving some of the van strength, Harper adds. “Three cities known for being retail distribution centers — Buffalo, Chicago, and Columbus — all saw nice rate hikes” in the past week, judging by the outbound averages for vans. “In terms of volume, Los Angeles moved back into the No. 1 position, with Atlanta No. 2 and Dallas No. 3.” You can find a van load pretty readily in all three markets, but average outbound rates there were mostly unchanged last week.

Hot van markets: Among those hot retail freight markets, rates rose the most in Buffalo, driving the outbound average close to $2 per mile ($1.98, to be precise). Rates also got a boost on eastbound lanes out of Chicago and Columbus, both averaging above $2.10 per mile now, due to a richer mix of outbound lane choices.

Not so hot: File under “who’s moving those loads.” The Denver market is always a tough place to find a load, and outbound rates dropped even further there last week. The Mile-High City may be the origin of this week’s Worst Lane in America: Denver to L.A., down 7 cents to an average 94 cents per mile.

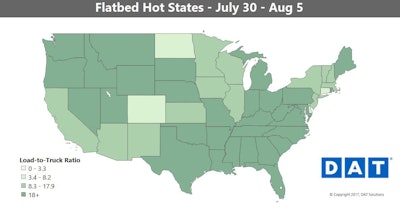

Hot markets: Atlanta and Memphis had a surprisingly good week, with outbound rates trending up in both markets. Rates out of the Midwest were expected to rise, and they did, in Cleveland and also in Rock Island, Ill. Out West, rates and volumes moved up out of Reno and Phoenix. The biggest flatbed market by far is Houston, which hit a plateau in July. There’s not much change, but outbound volume and rates have held up well over the past six weeks.

Not so hot: Freight volume was up, but rates were down, in three East Coast freight markets: Harrisburg, Pa.; Tampa, Fla.; and Roanoke, Va.