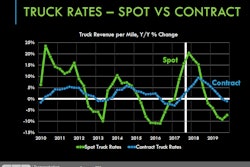

In general on the spot market this week, as represented in this case by activity on DAT load boards, “load posts and spot rates continue to decline seasonally,” says DAT’s Matt Sullivan. At once, it’s “basically the same story as the past couple of weeks,” with rising fuel prices also contributing slightly to the effect.

“The lack of other factors” like widespread weather impacts, Sullivan contends, “make it more obvious that these sustained elevated prices” at least related to the capacity/productivity impacts of the electronic logging device mandate, now in place for more than a month.

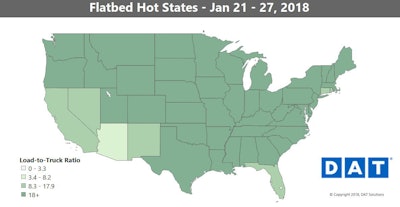

A booming energy sector contributed to higher flatbed load counts in January, but bad weather in some spots around the country through parts of the month also disrupted construction. As a result, changes in flatbed lane rates were pretty uneven.

A booming energy sector contributed to higher flatbed load counts in January, but bad weather in some spots around the country through parts of the month also disrupted construction. As a result, changes in flatbed lane rates were pretty uneven.Hot flatbed markets: Houston is the No. 1 market for flatbed loads, and volumes have been improving there, though rates haven’t followed suit yet. Farther north, outbound flatbed rates in Dallas rose 5 percent in January. Demand has also been heating up in Georgia, especially out of Savannah.

Not so hot: Flatbed demand weakened last month in Florida and Pennsylvania, though weather likely affected freight movements in Pennsylvania and kept the state dark in the map above. Florida, as is often the case, has a balance problem, where demand for inbound freight is much higher than the demand for outbound trucks. That pushed flatbed rates lower out of Tampa.

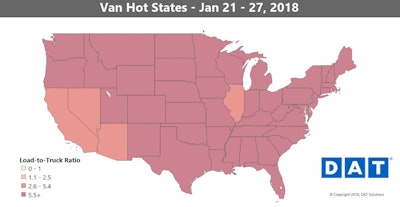

Van load posts fell for the third week in a row last week, as did the national average van rate. That’s typical for the end of January, but van rates still averaged $2.26 per mile last week, quite high for a national average. For comparison, the national average was just $1.67 per mile around this time a year ago.

Van load posts fell for the third week in a row last week, as did the national average van rate. That’s typical for the end of January, but van rates still averaged $2.26 per mile last week, quite high for a national average. For comparison, the national average was just $1.67 per mile around this time a year ago.Rising fuel costs, topping $3/gal. nationally in recent weeks, have added to the pressure on freight rates, slowing their seasonal decline a bit. But the big story remains a capacity crunch that’s put truckers in the driver’s seat on rates, partly a result of proliferating ELDs following the mandate.

Though rates on most of the top 100 van lanes continue to slide, most remain high.

Hot van markets: Atlanta and Houston ran counter to the national trend. Volumes were up 27 percent in Atlanta, while van load counts out of Houston surged 33 percent. Rates were down in Chicago, Dallas and Stockton, Calif., but the modest increases in volumes in each of those markets could offset the pattern of falling prices as we move into February.

Not so hot: Warmer weather around the Great Lakes brought van rates back down closer to earth in the Upper Midwest. Prices fell out of Chicago, despite higher volumes. The West Coast has seen the sharpest declines in January, especially Los Angeles. The upcoming Chinese New Year may also lead to a slowdown in traffic at the West Coast ports.

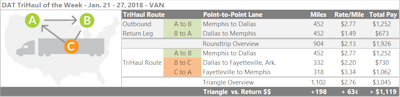

Van load-to-truck ratios out of Dallas have been a lot lower than the national number. Whatever the cause, the extra competition for freight there has pushed outbound van rates lower, so you might look to put together a triangular route to keep your rate per mile higher. For example, van loads going from Memphis to Dallas paid $2.77 per mile on average last week, but the return trip averaged only $1.49. The likely two-day, 900-mile roundtrip averages $2.13/mile and around and $1,000/day for revenue. A triangle option to break up the Dallas to Memphis return would add a third day with a load to Fayetteville, Ark., which paid $2.20 per mile last week on average. The last leg from Fayetteville to Memphis did even better, $3.34/mile. Altogether, splitting that return might add about 200 loaded miles. If you negotiated the market average for all those loads, your average rate per loaded mile would jump up from $2.13 to $2.76. That works out to a $1,000 boost in revenue, from $2,000 for the regular roundtrip to a little over $3,000 for the round.

Van load-to-truck ratios out of Dallas have been a lot lower than the national number. Whatever the cause, the extra competition for freight there has pushed outbound van rates lower, so you might look to put together a triangular route to keep your rate per mile higher. For example, van loads going from Memphis to Dallas paid $2.77 per mile on average last week, but the return trip averaged only $1.49. The likely two-day, 900-mile roundtrip averages $2.13/mile and around and $1,000/day for revenue. A triangle option to break up the Dallas to Memphis return would add a third day with a load to Fayetteville, Ark., which paid $2.20 per mile last week on average. The last leg from Fayetteville to Memphis did even better, $3.34/mile. Altogether, splitting that return might add about 200 loaded miles. If you negotiated the market average for all those loads, your average rate per loaded mile would jump up from $2.13 to $2.76. That works out to a $1,000 boost in revenue, from $2,000 for the regular roundtrip to a little over $3,000 for the round.