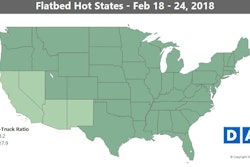

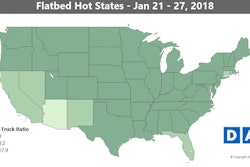

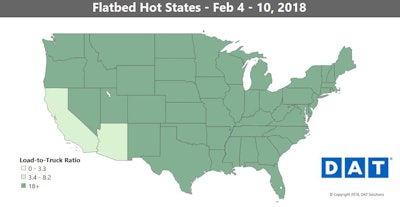

Flatbed trends have been mostly neutral overall in February. There are signs of spring, though, with higher volumes in many markets over the course of the past three weeks and many dark-green states in the map up above, an indication of high load-to-truck ratios on the board.

Flatbed trends have been mostly neutral overall in February. There are signs of spring, though, with higher volumes in many markets over the course of the past three weeks and many dark-green states in the map up above, an indication of high load-to-truck ratios on the board.Indications of the spring freight season rumbling up in the flatbed market were offset by a slump in volumes out of Houston this past week. The price for oil has gone from above $65 to below $60 per barrel, which could account for the decrease in demand in that market. Altogether, flatbed volumes have held steady following the uptick we saw at the end of January, however,

Hot markets: Flatbed rates have surged out of Rock Island, Ill., which suggests that farm equipment is on the move. John Deere, Olympic Steel and other manufactures have a strong footprint in that market. In the Southeast, rates improved in both Birmingham, Ala., and Savannah, Ga.

Not so hot: Rates were down sharply in Phoenix and Fort Worth, Texas, but both markets had rising volumes, which could reverse those pricing trends.

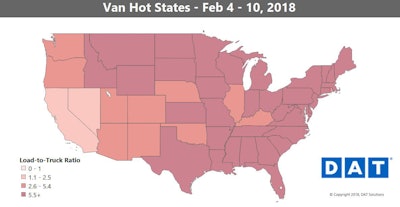

Spot market van volumes so far for February are slightly off compared to 2017, and van rates continue to decline seasonally though remaining well elevated above what they were last year. The loss in volume can be attributed in part to competition from railroads. Overall rail shipments are up slightly year over year, and in the fourth week of 2018, intermodal shipments were up 6 percent compared to last year.

Spot market van volumes so far for February are slightly off compared to 2017, and van rates continue to decline seasonally though remaining well elevated above what they were last year. The loss in volume can be attributed in part to competition from railroads. Overall rail shipments are up slightly year over year, and in the fourth week of 2018, intermodal shipments were up 6 percent compared to last year.Extra competition from rail/intermodal helped push van truckload rates lower, but despite the drop in prices, the national average van rate of $2.17 per mile is 60 cents higher than it was at this time a year ago. Higher fuel costs account for some of that difference, but the trends of the last few weeks suggest that the capacity shortfalls as a result of the ELD mandate have had a stronger impact on van rates than economic conditions.

Hot markets: Compared to the prior week, rates ticked down nearly everywhere last week. Charlotte was the leader, but outbound prices there rose only 1 percent on average. Van rates are still high in many places, though, even as prices are likely to fall for another week or two before springtime shipping starts to reverse trends. The “soft enforcement” period for the ELD mandate also is scheduled to end April 1, right as springtime demand should be ramping up. We could see a spike in load-to-truck ratios around then, similar to what we saw in mid-December when the enforcement period began.

Not so hot: Truckload capacity is loosest out West, meaning that shippers and brokers have had an easier time finding trucks in those markets. As a result, van rates in Los Angeles and Stockton, Calif., have fallen the sharpest in the past month. There were also sharp declines last week out of Allentown, Pa., and Buffalo, N.Y., giving back much of the increases from the previous week.