The number of loads on DAT load boards slipped 1.2% last week and truck posts increased 2% so it’s no surprise that load-to-truck ratios kept their balance:

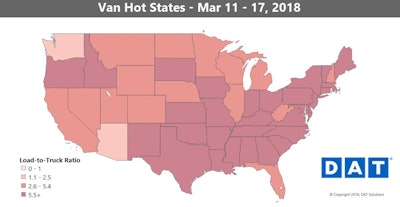

Van LT ratio = 6.8, unchanged

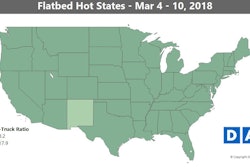

Flatbed LT ratio = 86.7, down slightly from 88.5

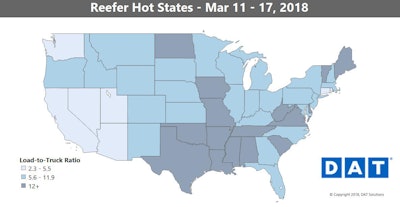

Reefer LT ratio = 10.1, down from 10.5

National average rates for all three equipment types were unchanged.

While the spot market may seem to be on a plateau, it’s on much higher ground compared to a year ago. Last week’s national average load-to-truck ratio was 14.1, nearly double what it was at this time last year. And spot van, flatbed, and reefer rates are well ahead of last year’s pace.

“The quarter close” upcoming this year “coincides with Easter and the start of the penalty phase for ELDs, and then we’re into the spring freight season, when the load board really starts hopping” typically, says DAT’s Peggy Dorf. Van, reefer closer looks follow:

The unchanged (from a week ago) national average van rate was $2.14/mile.

The unchanged (from a week ago) national average van rate was $2.14/mile.Overall, 54 of the Top 100 van lanes were up, 41 were down, and five were unchanged.

Hot markets: Houston is the leading van market in terms of spot-volume growth in 2018. Volume jumped 4.6 percent last week and Houston to Oklahoma City—a key lane for energy-related freight—gained 22 cents to an average of $2.35/mile. Allentown, Pa., outbound volume increased 2.6 percent as final-mile retail freight activity picked up ahead of Easter. Rates spiked on Allentown lanes into Northeastern markets: Allentown to Boston was up 28 cents to $4.01/mile.

Not so hot: Both Buffalo (down 2.2 percent) and Seattle (down 2.3 percent) had strong outbound volumes last week. Their slide may be a case of inbound traffic being even stronger, bringing capacity into the market.

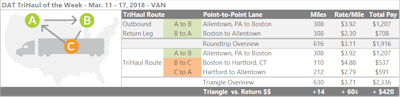

Today it’s pretty easy to find a good-paying load in Allentown, Pa., and rates from there to Boston are in the $4-per-mile range on average, to cover the tolls and any time you might be sitting in traffic. It can be hard to find a load out of Boston, but if you get one, they were paying on average $2.30/mile last week, for a round-trip average of $3.11/mile. That’s pretty good, but the roundtrip is 600-plus miles, and making it in a single day is pushing it. Plus, if you can’t find a load all the way back from Boston to Allentown, you could find yourself with a long deadhead. Instead, look for a shorter haul from Boston to Springfield, Mass., or Boston to Hartford, Conn., to reposition, and a second load to take you home. It all works with hours and load/unload timing, the stops in Hartford could boost your rate per mile, based on most recent averages, by another 14 cents to $3.25, an extra $400 or so in revenue for the trip on very few extra miles.

Today it’s pretty easy to find a good-paying load in Allentown, Pa., and rates from there to Boston are in the $4-per-mile range on average, to cover the tolls and any time you might be sitting in traffic. It can be hard to find a load out of Boston, but if you get one, they were paying on average $2.30/mile last week, for a round-trip average of $3.11/mile. That’s pretty good, but the roundtrip is 600-plus miles, and making it in a single day is pushing it. Plus, if you can’t find a load all the way back from Boston to Allentown, you could find yourself with a long deadhead. Instead, look for a shorter haul from Boston to Springfield, Mass., or Boston to Hartford, Conn., to reposition, and a second load to take you home. It all works with hours and load/unload timing, the stops in Hartford could boost your rate per mile, based on most recent averages, by another 14 cents to $3.25, an extra $400 or so in revenue for the trip on very few extra miles. The national average spot reefer rate was $2.40/mile, unchanged for the third straight week. Refrigerated freight volume rose 9 percent, led by increases in 13 of 17 major markets.

The national average spot reefer rate was $2.40/mile, unchanged for the third straight week. Refrigerated freight volume rose 9 percent, led by increases in 13 of 17 major markets.Reefer hot markets: Chicago load availability jumped 16 percent and rates on several outbound lanes were higher, while Green Bay rates rose despite lower volumes as the mix of freight shifts to shorter hauls of dairy, meat, and other non-produce loads. Lanes with gains:

**Chicago to Philadelphia, up 36 cents to $3.53/mile

**Chicago to Kansas City, up 36 cents to $3.53/mile

**Green Bay to Des Moines, up 52 cents to $3.09/mile

**Green Bay to Joliet, Ill., up 35 cents to $4.01/mile

More decent news? It’s fresh produce season somewhere. California volumes were up 7.6 percent last week—that state is no longer a headwind to reefer pricing. And Florida volumes will likely be up this week and next. Spring has sprung and fruits and vegetables are on the move.