Spring has sprung, and rates are popping up, says DAT’s Peggy Dorf with this week’s demand update in flat, van and reefer segments.

DAT’s Mark Montague checked the national average rates as of Tuesday, after the first business day of the new month, and they’re up. “This is not the typical trend,” Dorf says. “You’d expect the urgency to be gone after the end of the quarter and a major holiday” in Easter.

Perhaps the start of the ELD mandate’s penalty phase on Sunday added a bit of urgency to the market.

At once, it’s only one day, as Montague notes, so “it’s not a trend, it’s a data point.”

As data points go, this collection is pretty significant: Van rates are up 4 cents per mile, flatbed: 3 cents, and reefer rates jumped 5 cents, compared to the average for the month of March.

So much for March going out like a lamb. Nationally, the final week of the month featured a 3.5 percent increase in available freight, a 3.1 percent decrease in capacity, and another record high load-to-truck ratio for flatbed freight.

For a national average last week, flatbed rates sat at $2.53/mile, up 1 cent. Flatbed averages are as high as they’ve been since Summer 2014.

For a national average last week, flatbed rates sat at $2.53/mile, up 1 cent. Flatbed averages are as high as they’ve been since Summer 2014.With flatbed freight availability up 7 percent and capacity down 7.5 percent last week, the load-to-truck ratio jumped to 101.5. That surpasses the old record of 88 — from two weeks ago — by 15 percent. Every state in the lower 48 had a flatbed load-to-truck ratio of 18 or higher.

Van national average rates were up 2 cents to $2.15/mile, compared to the previous week.

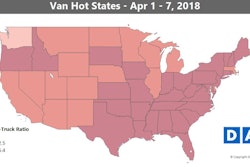

Van national average rates were up 2 cents to $2.15/mile, compared to the previous week.Van overview: Last week was the fifth straight week of increases for the national average van rate, a good sign. The number of available van loads was up 1 percent while truck posts declined 3 percent. The load-to-truck ratio was 7.2, up from 6.9 the previous week.

Hot markets: Houston, Dallas, and Memphis were all up at least 2.5 percent last week, reflecting strong shipper demand out of Midwest and Texas distribution hubs.

Regional van lanes to watch:

- Charlotte to Buffalo, up 31¢ to $3.04/mile

- Memphis to Indianapolis, up 22¢ to $2.58/mile

- Houston to New Orleans, up 14¢ to $2.93/mile

Not so hot: Chicago volume was down 4.4 percent, running counter to the trend.

Reefer rates heald steady for the fifth straight week headed into April Fool’s Day at $2.40/mile.

Reefer rates heald steady for the fifth straight week headed into April Fool’s Day at $2.40/mile.Reefer overview: The week before Easter is usually busy for reefer freight. But on the spot market, the number of reefer load posts dipped 1.2 percent last week while truck posts fell 2 percent. The 10.4 load-to-truck ratio was virtually unchanged compared to the previous week.

Hot markets: Strong reefer volumes and pricing from the Southeast and West are signs that shippers have produce to move. Key markets:

- Ontario, Calif., where volumes out of the Imperial Valley dipped slightly but the average outbound rate increased 2.9%. Ontario to Chicago was up 29¢ to $2.14/mile.

- Miami, where rates were up an average of 7.6% on higher volume. Miami to Baltimore was up 24¢ to $2.28/mile.

- Lakeland, Fla., where pricing rose an average of 4% compared to the previous week.

Not so hot: Those Florida and California markets countered weaker rates in Midwest dairy hubs like Grand Rapids, Mich. (down an average of 7.2 percent), and Green Bay, Wis. (down 6.8 percent).