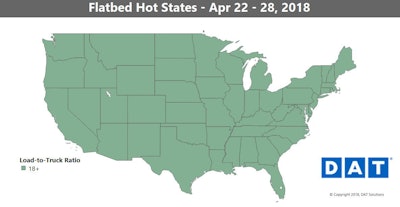

All that dark green in the map above? That means flatbedders utilizing DAT load boards have been busy, the board showing a big imbalance nearly everywhere between the number of posted flatbed loads and the number of posted available trucks. What’s more: It’s been that way since winter and the ELD mandate‘s inception.

There are no signs of a slowdown, either. Last week, flatbed volumes surged another 10 percent, led by Houston, Cleveland and Fort Worth, Texas. The national average rate for April was a record high at $2.65 per mile.

Hot markets: Atlanta continues to set new records – outbound rates there have climbed 10 percent in the past month. The oil industry has also fueled Texas markets: Rates rose in Dallas and Fort Worth, while Houston held firm. Gains out of Las Vegas and Jacksonville, Fla., suggest that construction equipment and material are on the move.

Not so hot: Of all the major flatbed markets, Phoenix is the only one where the average outbound rate is still below $2 per mile. The average last week was $1.79.

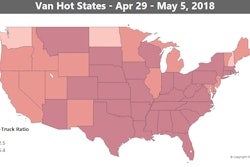

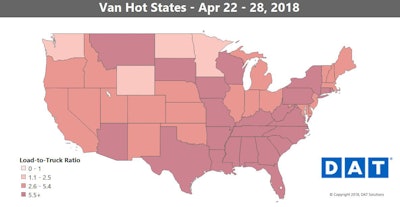

The van demand picture is generally more of a mixed bag in the last week, with the highest load-to-truck ratios centered across the South and East.

The van demand picture is generally more of a mixed bag in the last week, with the highest load-to-truck ratios centered across the South and East.Van rates spiked in early April, but the national average was in a steady decline for the rest of the month. That doesn’t paint the complete picture, though. The monthly average ended up being $2.16 per mile, 2 cents higher than the March average. And while a majority of the top 100 van lanes had falling prices last week, that could be a temporary blip.

Volumes have been building, and there were strong gains in five of the top six van markets. That could start to chip away at some of the excess truckload capacity that’s been building in the spot market lately, which would in turn put pressure on rates to go up as we move deeper into May.

Hot markets: Los Angeles moved up to No. 2 for volumes behind Dallas. Pricing-wise, there weren’t a lot of big gains on the top lanes, though rates were generally higher than they were a month ago.

Not so hot: The good news is that the two lanes with the biggest declines still had very high rates. Allentown, Pa., to Richmond, Va., fell 31 cents to an average of $2.52 per mile, while Columbus, Ohio, to Buffalo, N.Y., was down 30 cents at $3.78.

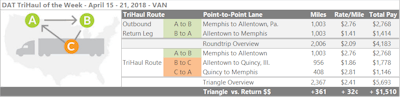

Getting into the Northeast at a good rate is not often an issue, but coming back out without losing your shirt is another story. For example, the van lane from Memphis to Allentown, Pa., is a 1,000-mile trip that averaged $2.76 per mile last week, but the trip back from Allentown only paid an average $1.41. Breaking the return into two legs with the Quincy, Ill., area, North of St. Louis, as a midpoint could boost your revenue by about $1,500. Allentown to Quincy paid an average of $1.86 last week, and loads from Quincy to Memphis paid $2.81 per mile. Altogether, the trip adds about 360 miles, not counting deadhead.

Getting into the Northeast at a good rate is not often an issue, but coming back out without losing your shirt is another story. For example, the van lane from Memphis to Allentown, Pa., is a 1,000-mile trip that averaged $2.76 per mile last week, but the trip back from Allentown only paid an average $1.41. Breaking the return into two legs with the Quincy, Ill., area, North of St. Louis, as a midpoint could boost your revenue by about $1,500. Allentown to Quincy paid an average of $1.86 last week, and loads from Quincy to Memphis paid $2.81 per mile. Altogether, the trip adds about 360 miles, not counting deadhead.