“Spot rates and volumes are looking strong to start May,” notes DAT analyst Matt Sullivan with this report demand report. That’s particularly true for van freight, but for reefers, “produce markets are hitting high gear.”

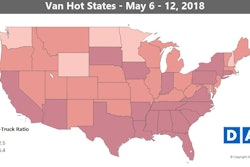

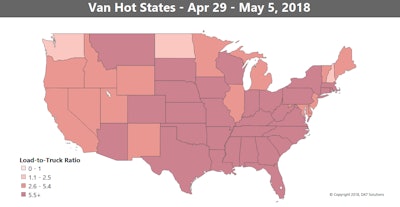

“Spot rates and volumes are looking strong to start May,” notes DAT analyst Matt Sullivan with this report demand report. That’s particularly true for van freight, but for reefers, “produce markets are hitting high gear.”April is in the rearview, and so is the recent trend of falling spot market rates. May got off to a hot start, pushed by higher truckload volumes across a wide swath of the country last week, though the highest demand is on lanes heading into the Northeast. And that extra capacity we’ve seen on the spot market in the past month or so? It’s fading in the load-to-truck ratios on average around the nation, as you can see in the demand indicator map of states above.

The spring freight season may be a little late this year, but it’s here.

Hot markets: It wasn’t all about inbound loads to the Northeast last week. Los Angeles moved up to No. 1 for van load originations, followed by Dallas at No. 2. Retail freight is also back after the winter lull, which we can see in the higher rates on lanes like Memphis to Columbus, Ohio, which is heavily influenced by retail shipments.

Not so hot: Higher inbound rates to the Northeast seemed to put downward pressure on prices coming out. Rates out of Philadelphia, Allentown, Pa., and Buffalo, N.Y., all edged downward, but the biggest declines were out of Seattle.

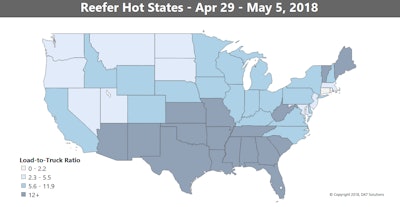

Produce markets across the country kicked into high gear last week, but reefer trends overall were driven by the Southeast. Reefer load counts are building in California as well, while Texas markets are still holding strong.

Produce markets across the country kicked into high gear last week, but reefer trends overall were driven by the Southeast. Reefer load counts are building in California as well, while Texas markets are still holding strong.Reefer hot markets: Reefer volume/rate increases were huge out of Miami and Lakeland, Fla., with several outbound lanes surging over $3 per mile. For example, Miami to Boston shot up 79 cents to an average of $3.05 per mile. It wasn’t just Florida, though. Tifton in Southwest Georgia might have been the hottest market for produce last Friday.

Not so hot: Prices fell on some Midwest lanes. Grand Rapids, Mich., to Madison, Wis., faltered 62 cents to $2.72 per mile, while the average reefer rate on the lane from Green Bay, Wis., to Des Moines, Iowa, declined 31 cents to $2.44 per mile.