More trucks posting availability on the spot market last week, after a tight squeeze during the previous week’s Roadcheck inspection blitz, put what would seem to be downward pressure on rates into this week. However, shippers and brokers, given the load-to-truck demand indicators remaining above average, are still having a hard time finding truckload capacity overall.

Truckers thus continue to exercise plenty leverage in spot negotiations, and those shippers and brokers are paying a premium to move spot freight.

June is on track for the highest ever national averages for rates in each equipment type tracked — van, reefer and flatbed. Spot market rates are also higher than contract rates for all three trailer types, meaning brokers are paying more than shipper-direct contract rates for comparable hauls on average. That won’t be true for every load on every lane, of course.

Strong volumes on the top 100 van lanes last week suggest that the rate spikes we saw during the Roadcheck blitz could be part of a sustained rise.

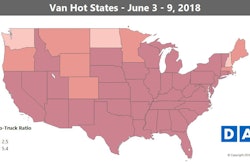

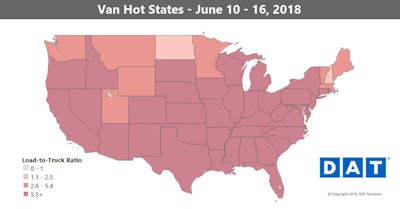

Strong volumes on the top 100 van lanes last week suggest that the rate spikes we saw during the Roadcheck blitz could be part of a sustained rise.Hot van markets: As high as the national van rate has been this month ($2.30 per mile), prices have been even higher on the top 100 van lanes. Last week, volumes rose by double-digit percentage points in key markets like Dallas, Chicago and Atlanta, and load counts continued to climb in the top market of Los Angeles.

Not so hot: Only a handful of major lanes had rates fall by more than 10 cents per mile. For example, Buffalo, N.Y., to Chicago dropped 14 cents to an average of $1.94 per mile. The Houston to Dallas lane has been hot lately, but it also fell back 14 cents last week to $2.83.

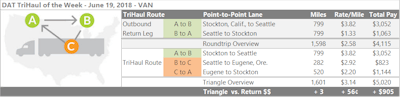

Out on the West Coast, van loads from California to Seattle are paying well as a general rule. But part of the reason rates on the Los Angeles and Stockton lanes to Seattle have been so high is because you’ll probably have a harder time finding a good-paying load coming straight back out. The return trip from Seattle to Stockton averaged just $1.33 per mile last week on DAT Load Boards. You could try taking advantage of the higher prices on the lane from Seattle to Eugene, Ore., which paid an average of $2.92 per mile. From there you could look for a load back to Stockton, with an average rate of $2.20 last week. This is basically just an extra stop on the way back down I-5, so any extra miles will be whatever deadhead is added between your extra drop and pick. Not counting deadhead, it could push your average rate per mile up from $2.58 for the normal there-and-back to $3.14 with the extra stop, based on the averages, or about $900 bucks for the round. If you can’t find loads in and out of Eugene, you might look into Medford or Springfield, Ore., or maybe head a little farther off I-5 to Bend, Ore.

Out on the West Coast, van loads from California to Seattle are paying well as a general rule. But part of the reason rates on the Los Angeles and Stockton lanes to Seattle have been so high is because you’ll probably have a harder time finding a good-paying load coming straight back out. The return trip from Seattle to Stockton averaged just $1.33 per mile last week on DAT Load Boards. You could try taking advantage of the higher prices on the lane from Seattle to Eugene, Ore., which paid an average of $2.92 per mile. From there you could look for a load back to Stockton, with an average rate of $2.20 last week. This is basically just an extra stop on the way back down I-5, so any extra miles will be whatever deadhead is added between your extra drop and pick. Not counting deadhead, it could push your average rate per mile up from $2.58 for the normal there-and-back to $3.14 with the extra stop, based on the averages, or about $900 bucks for the round. If you can’t find loads in and out of Eugene, you might look into Medford or Springfield, Ore., or maybe head a little farther off I-5 to Bend, Ore. Additional capacity last week had a bigger impact on reefer markets than on dry vans. While the national average reefer rate ticked up to $2.70 per mile (just short of the record set in early January), many high-traffic lanes had lower prices.

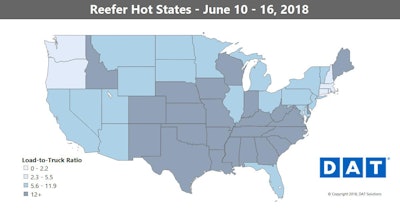

Additional capacity last week had a bigger impact on reefer markets than on dry vans. While the national average reefer rate ticked up to $2.70 per mile (just short of the record set in early January), many high-traffic lanes had lower prices.Hot reefer markets: Prices rose on lanes from California up to the Pacific Northwest. Los Angeles to Portland, Ore., climbed 20 cents to an average of $4.13 per mile. One surprise lane last week: Miami to Baltimore jumped up 35 cents to $2.72.

Not so hot: Most Florida rates, however, were down. Lakeland, Fla., to Atlanta dropped 56 cents to $1.91 per mile. The biggest decline was on the lane from Dallas to Denver, which lost a whopping 70 cents but still averaged $2.94 per mile.