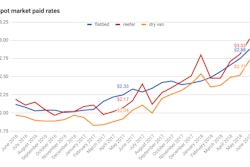

As was expected leading up to the final week of June, the month closed with the highest average spot market rates on record, according to the folks at DAT. The end of the second quarter and the urgency ahead of the Fourth of July holiday kept up considerable pressure on prices.

“Reefer and flatbed spot market averages” continued higher than “the contract rate averages,” noted DAT analyst Matt Sullivan, while contract rates caught up with spot van rates.

As of last week, the national average van rate on the spot market was equal to the average shipper-direct contract rate at $2.31 per mile.

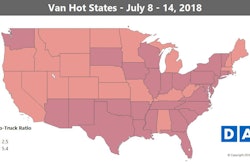

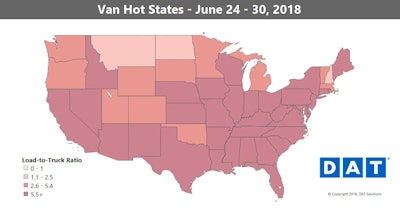

As of last week, the national average van rate on the spot market was equal to the average shipper-direct contract rate at $2.31 per mile.Hot van markets: Memphis had a huge load-to-truck ratio on Friday, trailing only Atlanta in load counts at the end of the week. There were big increases out of nearly every major van market, and prices rose on 82 of the top 100 van lanes. The top three increases were all out of Memphis, with lanes to Chicago; Indianapolis; and Columbus, Ohio, all up at least 37 cents per mile.

Not so hot: Rates were stable out of Houston and Seattle, which counted as “cold” last week when compared to everywhere else. Otherwise, there weren’t many declines. The biggest was on the lane from Chicago to Buffalo, N.Y., which slipped from its previous highs down to an average of $2.93 per mile.

Reefer rates also set a record high in June. The national average spot market rate was a whopping 11 cents higher than the average contract rate, hitting $2.69 per mile. June is the traditional peak for reefer rates, so we expect prices to begin to retreat in July, though that might happen at a much slower pace than usual given tight conditions this year.

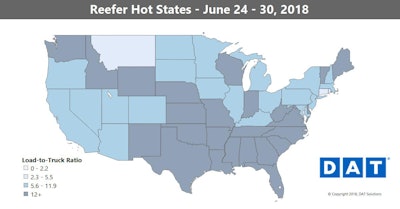

Reefer rates also set a record high in June. The national average spot market rate was a whopping 11 cents higher than the average contract rate, hitting $2.69 per mile. June is the traditional peak for reefer rates, so we expect prices to begin to retreat in July, though that might happen at a much slower pace than usual given tight conditions this year.Hot reefer markets: Demand in California shifted northward, with outbound rates in Sacramento climbing 9 percent last week. Capacity is still tight in the Southeast, which contributed to a 7 percent uptick in reefer rates out of Atlanta. The lane to Philadelphia soared 57 cents to an average of $4.08 per mile.

Not so hot: While Northern California was hot for reefers last week, the southern part of the state was lackluster. The border markets of Nogales, Ariz., and McAllen, Texas, also trended downward.