The national average spot van rate increased 6 cents during the week ending Dec. 8, though demand for trucks looked weaker on high-traffic lanes for retail and e-commerce freight, noted DAT Solutions, speaking toward information cleaned from freight moving through the DAT network of load boards and the DAT RateView tool. The average spot reefer rate slipped during the same week, while the flatbed rate made a gain for the first time in five months.

National Average Spot Truckload Rates

Van: $2.14/mile, up 6 cents compared to the previous week

Flatbed: $2.43/mile, up 3 cents

Reefer: $2.46/mile, down 2 cents

National Average Load-to-Truck Ratios:

Van: 5.5 loads per truck, down from 7.2.

Flatbed: 19.8, down from 23.9 loads per truck. The number of flatbed load posts fell 4 percent while truck posts increased 16 percent compared to the previous week.

Reefer: 8.3 loads per truck. Reefer load posts slipped 16 percent as truck posts rose 9 percent.

Falling fuel prices continue to exert downward pressure on spot rates, which incorporate a surcharge portion. The national average price of on-highway diesel fell more than 4 cents to $3.16/gallon last week, its lowest point since April.

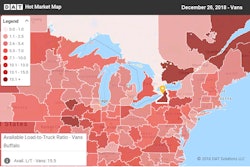

Trend to Watch: Van freight momentum

The number of van load posts on DAT load boards was down 13 percent last week while truck posts surged 53 percent as truckers returned from the previous holiday week.

Despite the higher national average rate, momentum in the spot van market stalled by midweek as freight volumes fell 5.3 percent on the Top 100 lanes. Rates on those lanes slumped as well, with 62 lanes down an average of 1.9 percent, or roughly 4 cents per mile, compared to the previous week. There were large drops in van freight activity in Atlanta, where the number of posted loads fell by 11.3 percent. Out of Los Angeles, too, posted load counts were down 8.9 percent, among other van freight hubs.

Absent a rebound this week, the anticipated holiday peak for van freight appears to be muted.

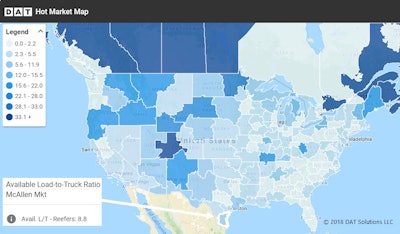

Market to Watch: Reefers from McAllen

The average reefer rate from McAllen was $2.21/mile, up 3 cents on higher produce volume.

The average reefer rate from McAllen was $2.21/mile, up 3 cents on higher produce volume.McAllen, Texas, is an important market for agricultural products grown on both sides of the U.S.-Mexico border in the Rio Grande Valley. Two key McAllen lanes reflected higher outbound reefer rates and more load volume last week, indicating strong seasonal demand from shippers:

**McAllen to Dallas: $2.78/mile

**McAllen to Chicago: $2.02/mile

Rates held steady on two other high-traffic lanes from McAllen: to Elizabeth, N.J. ($2.22/mile), and Atlanta ($2.35/mile). That’s good news for reefer haulers looking to capitalize on a strong produce market just before the holidays.