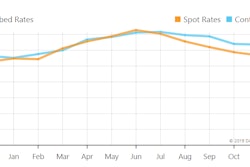

Truckload capacity, with more truckers advertising their availability to haul via the load boards, is building in the first weeks of 2019. National average spot rates for dry van, reefer and flatbed are going the other direction.

Showing signs of the mid-Winter seasonal slump getting well under way, the number of trucks on the spot truckload freight market increased 7 percent last week, building on huge increases the week before that, while the number of loads fell 10 percent, said DAT Solutions, which operates the DAT network of load boards.

Spot rates followed the downward demand trend, though declining fuel prices also played a role.

National Average Spot Rates

*Van: $2.01/mile, down 4 cents

*Flatbed: $2.38/mile, down 4 cents

*Reefer: $2.37/mile, down 5 cents

National Average Load-to-Truck Ratios

*Van: 3.7, down from 4.6. That’s the lowest ratio since May 2017.

*Flatbed: 21.7, down from 25.1

*Reefer: 4.9, down from 6.1

Trend to watch: Slumping van rates out West

The worst drops in spot van rates over the past month have been from the West Coast — Los Angeles and Seattle are down by double-digit percentages since December. This is not totally unexpected: the threat of higher tariffs pushed overseas shippers to get their freight to the U.S. as quickly as possible during the last quarter of 2018, when volumes surged. Now? Not so much.

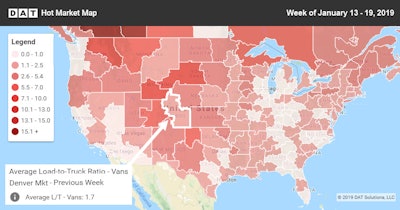

Market to watch: Denver

Genuinely hot markets are typically the subject of this section of the weekly update, and the notoriously difficult Denver market by any measurement almost never qualifies. But considered another way, “hot” can be a relative term. While Denver outbound has been mostly neutral for the last month, several lanes are looking up. For instance, the average rate from the Denver market area to that in Albuquerque, N.M., is above $2.00/mile, and the return trip is solidly above $2.50.

Denver opportunity by day of the week | It’s easiest to find a load out of Denver on a Tuesday, and the next best day is Wednesday. Last week, there were more than 1,000 loads posted in the Denver market on Tuesday and Wednesday, and the load-to-truck ratio was about 2.5. Truck posts are highest on Mondays, so there’s more competition chasing fewer opportunities on that day.

Denver opportunity by day of the week | It’s easiest to find a load out of Denver on a Tuesday, and the next best day is Wednesday. Last week, there were more than 1,000 loads posted in the Denver market on Tuesday and Wednesday, and the load-to-truck ratio was about 2.5. Truck posts are highest on Mondays, so there’s more competition chasing fewer opportunities on that day.