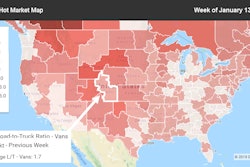

The load-to-truck demand indicators for truckers in the spot freight markets retained solid footing last week despite slippery winter weather. The number of spot-market loads fell just 2 percent, compared to an 8 percent drop in the number of trucks posting availability, said DAT Solutions, which operates the DAT network of load boards.

Given the prior week’s slackening demand indicators, however, rates lost a bit of traction. Spot van, reefer, and flatbed prices slipped lower for the third straight week, and the van rate skidded below $2 for the first time since September 2017.

National average spot rates

*Van: $1.97/mile, down 4 cents

*Flatbed: $2.37/mile, down 1 cent

*Reefer: $2.34/mile, down 3 cents

National average load-to-truck ratios

*Van: 4.0, up from 3.7, a 20-month low

*Flatbed: 21.1, down marginally from 21.7

*Reefer: 5.6, up from 4.9

Trend to watch: The weather

Temps flatlined, dipping well negative in some places, across the busy Midwest and much of the Eastern United States this week. That led to some cancelled pickups Wednesday morning for small fleet owner-operator Daniel Davidson, owner of Northern Ohio-based Davidson Trucking, hauling mostly dry van freight. “I was out running this morning,” he noted late in the day, but shippers “ended up canceling our load, so I headed back to the barn.”

One among many in such extreme cold, no doubt, leading a slowdown in trucking operations as shippers and receivers can have trouble maintaining staffing levels and logistics commitments.

These dynamics tend to drive rates up while slowdowns in business and consumer activity tend to push them down. Normally, that’s good news for truckers — there’s money to be made. But the latest arctic freeze has been severe, dangerous for anyone spending any extended length of time exposed to the elements. Be safe out there, and watch for the upside as the thaw sets in.

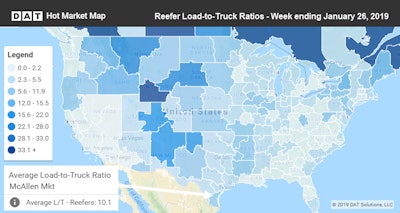

Market to watch: McAllen, Texas

Reefer rates have cooled off across the country, but a few hot spots still remain. Demand for trucks can be fierce in the Twin Falls, Idaho, market, and in East Coast port areas like Philadelphia and Elizabeth, N.J.

The McAllen, Texas, reefer market contains more than just U.S. areas thanks to the fertile Rio Grande Valley and growers on both sides of the U.S.-Mexico border. Food processing plants and cold storage facilities abound in the McAllen market, which includes nearby Pharr and Brownsville.

The McAllen, Texas, reefer market contains more than just U.S. areas thanks to the fertile Rio Grande Valley and growers on both sides of the U.S.-Mexico border. Food processing plants and cold storage facilities abound in the McAllen market, which includes nearby Pharr and Brownsville.The outbound load-to-truck ratio in McAllen was above 10-to-1 last week, which is almost twice the national average for reefer freight. The demand drove rates up to an average of $2.30/mile, 4 cents better than the previous week. McAllen to Dallas averaged $2.93/mile, down 7 cents compared to the previous week but still 12 cents better than the December average.