Mark Eichinger pitches his company’s FreightTracer track-and-trace product and NavigatorTMS transportation management software as small-fleet/independent-owner-op solutions to help compete on a level playing field “with the larger organizations” when it comes to technology and what they can offer prospective customers. With such systems in place and put to use, he says, small carriers “can show their customers where they are to provide that level of service” to an increasingly high-touch group when it comes to expectations management.

As illustrated in the “Covering your tracks” feature in the December issue of Overdrive, shipper/broker expectations of in-transit location tracking, “visibility” in the moderately Orwellian parlance, is ever growing. FreightTracer is another way for carriers perhaps to take hold of that tracking as a service to the customer (in some instances charging a small fee for it, as has been suggested), rather than relying on a multiplicity of solutions handed down from brokers or other customers.

The system works in a manner similar to Descartes Macropoint, Trucker Tools’ Load Track functionality and FreightPrint, among others, tracking movement of loads by pinging drivers’ smartphones. Within the control dashboard, sending links to allow location monitoring by customers can happen with the simple push of a button.

FreightTracer funtionality is integrated within NavigatorTMS ($99 monthly for a carrier, plus $49 monthly for each added user), too. Both grow out of Eichinger’s business partner in the venture, the American Diamond Logistics brokerage, who built the early version of the software for its own operation more than 15 years ago. “About five years ago,” Eichinger and company began to take it to a software-as-a-service platform with refinements to market it to other brokers and, particularly, smaller fleets.

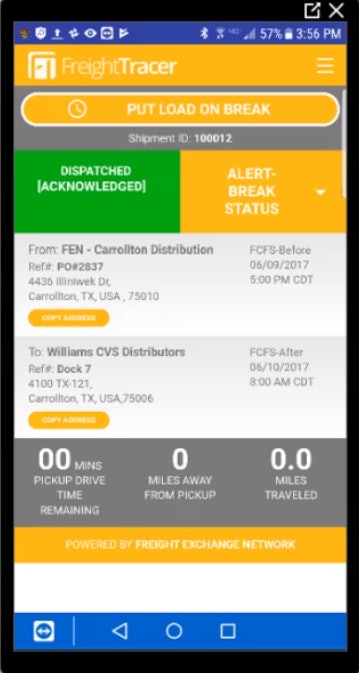

This active-load screenshot from within the FreightTracer driver app (Android and iOS), companion to the overall system, shows a key element of the service, the ability via the top button here for the driver to pause the track when on break to alert the back office and/or brokers utilizing the service in partnership that he/she is off-duty. For a carrier, FreightTracer use with direct customers and drivers comes with a $19.99 monthly service fee per truck.

This active-load screenshot from within the FreightTracer driver app (Android and iOS), companion to the overall system, shows a key element of the service, the ability via the top button here for the driver to pause the track when on break to alert the back office and/or brokers utilizing the service in partnership that he/she is off-duty. For a carrier, FreightTracer use with direct customers and drivers comes with a $19.99 monthly service fee per truck. After piloting the broker version of the integrated products for more than a year, the company’s going to market now, and within Navigator small carrier operators can set up views into:

- Delivery-performance and other metrics by all customer locations — via the software, carriers “can generate scorecards for customers” illustrating such metrics and actually “send this to customers,” Eichinger notes. “A lot of people aren’t doing that, but it can be pretty powerful” in enhancing the relationship.

- Current moves and what status each is in, including via the built-in FreightTracer module a map-based view of load locations in transit.

- As noted above, the quick ability to share links to live load locations with customers as the load nears destination.

- Via the drivers’ app on their smartphones, integration with Dock411’s location-info service allows easy access to information about new and existing locations for delivery/pickup.

And more.

The company has a free trial available to prospective customers for both NavigatorTMS and FreightTracer, likewise the integrated product. “A lot of smaller carriers could probably use FreightTracer standalone to get started,” Eichinger says. When they move beyond a truck or two, “if they wanted to start using the back office” software, “we can move them to Navigator – once you start managing multiple trucks it probably makes sense to go to the TMS.”