Like green shoots emerging through the snow, national average spot truckload rates showed signs of life last week, an indication that demand for trucks is starting to build.

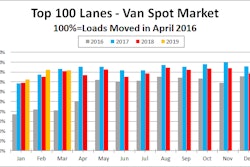

But the pricing traction for truckers was not widespread, said DAT Solutions, which operates the DAT network of load boards: van and reefer load-to-truck ratios declined during the week ending March 9, and any better-paying freight in both segments was concentrated on a handful of lanes and regions. The picture for flats may be somewhat better, with load-to-ratios up slightly with a small boost in average national rates as well. Often, during a week following a boost in ratios, rates move accordingly.

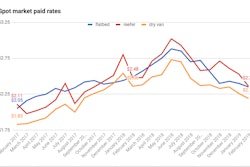

National average spot rates

Van: $1.88/mile, unchanged

Flatbed: $2.34/mile, up 1 cent

Reefer: $2.21/mile, up 1 cent

National average load-to-truck ratios

Van: 4.2 loads per truck, down from 4.6

Flatbed: 25.9, up from 25.7

Reefer: 5.6, down from 6.0

Trend to watch: Produce markets

The national average reefer rate ticked up a cent to $2.21/mile this past week but the market remains in a seasonal lull. On the top 72 reefer lanes last week, rates on 29 of them moved higher while 40 lanes declined. Three were flat. Volumes were down only slightly from the previous week. Clearly, they’re not yet rising except for in a few areas where produce season is kicking in.

Average outbound rates increased in Fresno, Calif., and McAllen, Texas, two of the nation’s top produce markets. Reefer lanes with big price increases included McAllen to Dallas, up 23 cents to $3.03/mile, and Fresno to Denver, up 9 cents to $2.45/mile. But rates outbound from the Lakeland, Fla., area slipped 6 cents to a paltry $1.46/mile, and Lakeland to Chicago had the lowest rate among major lanes originating from the Southeast region, down 8 cents to an even worse $1.30/mile. The growing season is still under way in Florida.

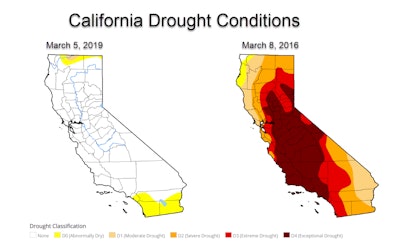

Market to watch: California

California grows more produce than any other state, and harvests are a huge driver of reefer demand. In fact, four of the top five reefer markets last year were in California: Fresno, San Francisco, Los Angeles and Ontario. Harvests affect capacity in the van and flatbed segments as well, as power units are diverted to cover higher-paying reefer loads out West.

California experienced three years of drought from 2014 to 2016, which led to loss of crops, reduced yields, shorter growing seasons, and slack demand for trucks. But today the snowpack in the Sierra Nevada mountains is the fifth largest in the past 40 years, and many of the state’s reservoirs are at above-average levels. If growers produce more than they planned for this year, as usual they’ll turn to the spot market for capacity.

California experienced three years of drought from 2014 to 2016, which led to loss of crops, reduced yields, shorter growing seasons, and slack demand for trucks. But today the snowpack in the Sierra Nevada mountains is the fifth largest in the past 40 years, and many of the state’s reservoirs are at above-average levels. If growers produce more than they planned for this year, as usual they’ll turn to the spot market for capacity.