Just when spot rates seemed ready for an upward swing, they took another hit.

Weather was a factor in tamping down rates during the week ending March 16, said DAT Solutions, which operates the DAT network of load boards. As reported here in Overdrive, snow in the Rockies closed parts of I-25, I-70, and I-76 last week, and historic flooding in and around Nebraska shut down I-80. Near Amarillo, Texas, 80-mile-an-hour winds toppled tractor-trailers moving down the highway.

With disruptions to so many vital truck routes, it’s notable that the number of loads moved last week increased 3.5 percent compared to the previous week. The number of trucks posted on the boards gained 3.4 percent, which left van and reefer load-to-truck ratios slightly weaker.

National average load-to-truck ratios:

**Van: 1.6 loads per truck

**Reefer: 2.9 loads per truck

**Flatbed: 22 loads per truck

National Average Spot Truckload Rates

**Van: $1.86/mile, down 2 cents

**Reefer: $2.19/mile, down 2 cents

**Flatbed: $2.34/mile, unchanged

Trend to watch: Van volumes

Van freight volumes are relatively strong right now, with March on track to beat 2018 volumes. But a March surge in loads moved relative to last month has yet to surface. Data here is from DAT Solutions.

Van freight volumes are relatively strong right now, with March on track to beat 2018 volumes. But a March surge in loads moved relative to last month has yet to surface. Data here is from DAT Solutions.Spot van volumes remain ahead of March 2018, but so far the demand for trucks is no better than in February this year. Capacity is abundant, and rates are drifting: On DAT’s top 100 van lanes last week, pricing fell on 53 and rose on 36. Eleven lanes were neutral.

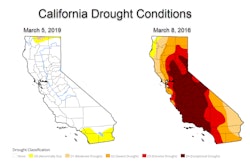

Market to watch: The Midwest

Large sections of the U.S. Midwest are struggling with unusual weather. So watch for a ripple effect in supply chains. For instance, the challenge of getting freight into Denver last week led to an increase in rates from Seattle to Salt Lake City. The extra West Coast trucks in SLC caused rates on the lane from there to Stockton to decline.

While the weather has kept van rates in check, expect a boost in flatbed pricing as the demand to move heavy machinery and construction materials into the region picks up.