Spot truckload freight posting volume was virtually unchanged during the week ending March 31, while the number of truck posts increased 5 percent, keeping van and reefer rates in check during the final week of March and Q1 2019.

Van load-to-truck ratios over the course of the last week, shown above, remained at generally low levels throughout as a national average.

Van load-to-truck ratios over the course of the last week, shown above, remained at generally low levels throughout as a national average.Last week’s relatively quiet freight market was in keeping with the rest of the month, said DAT Solutions, which operates the DAT network of load boards.

National average spot rates, March 2019:

Van: $1.86/mile, down 3 cents from the February average

Reefer: $2.18/mile, also down 3 cents from February

Flatbed: $2.35/mile, up 2 cents compared to February’s average

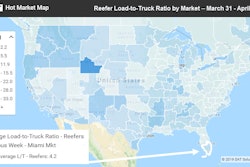

Trend to watch: Reefer volumes

The relative dearth of spot reefer freight is hurting truckload prices overall. On the top 72 reefer lanes last week, 42 lanes were down, 24 were up, and six were unchanged. The average reefer load-to-truck ratio in March was 2.9, down from 3.7 in February.

Spring harvests can’t come fast enough. There were brighter signs in Lakeland, Fla., where reefer volumes were more than 20 percent higher last week and the average outbound rate ticked up 2 cents to $1.49/mile. But weather in the Midwest and Plains is taking a heavy toll on farm production and transportation. The average outbound rate from Grand Rapids, Mich., fell 19 cents to $3.06/mile, and two lanes keyed last week’s slump:

**Grand Rapids to Cleveland was down 31 cents to $3.83/mile

**Grand Rapids to Atlanta dropped 22 cents to $2.51/mile

Market to watch: Houston flatbeds

At $2.39/mile, the national average spot flatbed rate has risen for five consecutive weeks. In the top 78 flatbed lanes, rates moved higher on 36 lanes while 42 were lower, although flatbed rates have increased 4 percent overall in the past two weeks.

Plenty of flatbed markets in the South and East experienced rising spot rates last week, and one lane in particular caught our attention: Houston to Oklahoma City jumped 38 cents to $2.55/mile. That’s a good sign for oil and gas-related activity.