The weather is warming up and the freight is out there — in fact, van freight volumes for May are as high as they’ve ever been.

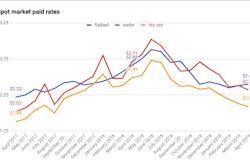

But an abundance of capacity continued to keep spot truckload rates at less-than-stellar levels — and falling for vans compared to the April average — during the week ending May 19, said DAT Solutions. Van and refrigerated load-to-truck ratios only marginally improved.

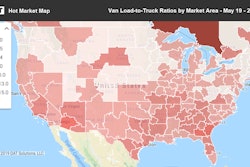

The spot van load-to-truck ratio was virtually unchanged at 1.6 last week, continuing a trend of solid volumes and unspectacular rates in May.

The spot van load-to-truck ratio was virtually unchanged at 1.6 last week, continuing a trend of solid volumes and unspectacular rates in May.National average spot rates through May 19

**Van: $1.80/mile, 1 cent lower than the April average

**Reefer: $2.17/mile, 2 cents higher than April

**Flatbed: $2.29/mile, 4 cents lower than April

Trend to watch: When will reefer freight rates take off?

Overall, reefer load volumes are higher than they were at this time last year, and the number of reefer load posts did increase late in the week. Reefer spot rates this month continue to trend slightly ahead of the April average.

However, only 23 of the top 72 reefer lanes had rising rates. The Midwest remains in bad shape. Florida was weaker than expected compared to the previous week, with Miami reefer volumes down more than 15% and the average outbound spot reefer rate off 32 cents to $2.21/mile.

The bright spot last week was California, where outbound loads dropped 7% overall but major reefer markets produced some of the biggest rate gains last week. The average rate coming out of Los Angeles increased 4 cents to $2.76/mile, and several lanes originating in California were higher:

**Los Angeles to Denver, up 30 cents to $2.90/mile

**Ontario to Chicago, up 16 cents to $2.12/mile

**Fresno to Seattle, up 11 cents to $2.75/mile

Market to watch: Houston vans

On the top 100 van lanes, rates went up on 46 lanes while 44 lanes were down and 10 were unchanged. As noted in the graphic above, the van load-to-truck ratio was virtually unchanged at 1.6 available loads for every truck posted on DAT load boards.

In Houston, the average outbound rate gained 4 cents to $1.75/mile, buoyed by demand on high-traffic van lanes like Houston to Oklahoma City (up 15 cents to $2.01/mile).