—

Though the ongoing strikes by United Auto Workers at General Motors appear to be nearing an end, some carriers have been hit hard by the lingering work stoppage.

One 200-truck carrier contacted Wednesday by Overdrive reported having laid off more than 50 drivers. Jason Todd, head of operations for Phoenix Transit and Logistics, says his company’s work has been halted by the strikes, and their trucks have sat loaded — but idle — since last Monday. “We’re losing a lot of money, but there’s nothing we can do,” Todd said Wednesday. “We usually do 300 loads a week of auto parts, racks. But every shipment has stopped.”

The strikes are costing the carrier about $100,000 a day in revenue, he says. GM has been firm that they won’t reimburse carriers for the lost revenue, nor will they pay extra for the loads that have been backlogged, Todd says.

Drivers have also been mostly blocked from making deliveries, says Todd. “We had a truck smashed up last week,” he says, on the second day of the strike at a GM plant in Flint, Michigan. Someone threw a full soda bottle at the truck and it “busted out a mirror.”

Though UAW and GM appear to be close to an agreement to end the strikes, it’s unclear when the deal will be finalized and when the striking GM workers will return to work.

Even after GM facilities resume operation, the swell of backlogged loads caused by the strike will take weeks to sort out, says Todd, which will likely continue to hamper his and others’ operations.

“It’s going to take a while to get the pipeline up and running,” says Kevin Burch, president of Jet Express and former chairman of the Truckload Carriers Association. Jet Express serves GM suppliers and plants, too. But his fleet is diverse in its customer base, he says, and hasn’t been as severely harmed by the strikes as Phoenix.

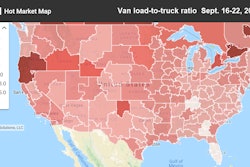

Providing analysis Monday, DAT analyst Mark Montague couldn’t point to broader impacts the strikes are having on spot market freight. But he did notice a pronounced drop in certain northeast lanes. For instance, he says, the lane from Columbus, Ohio, to Buffalo dropped 12 cents last week. “That may be in part due to less auto parts traffic from U.S. plants to Canada through the Buffalo gateway,” he said.