Trucking news and briefs for Wednesday, Dec. 16, 2020:

Pennsylvania, New Jersey, New York restricting commercial traffic during winter storm

In preparation for a major winter storm expected in the Northeast through Friday, Pennsylvania, New Jersey and New York are restricting commercial vehicle traffic on certain major highways.

The Pennsylvania Department of Transportation and the Pennsylvania Turnpike Commission have instituted the following restrictions on commercial vehicles: no tractors without trailers, tractors towing unloaded or lightly loaded enclosed trailers, open trailers or tank trailers, tractors towing unloaded or lightly loaded tandem trailers, enclosed cargo delivery trucks that meet the definition of a CMV. The restrictions begin at 1 p.m. Eastern Wednesday.

The commercial vehicle bans in Pennsylvania are effect on I-78, I-80 (I-99 to New Jersey), I-81, I-83, I-84, I-95, I-283, I-295, I-380, I-676, PA-33, I-76 (Breezewood to New Jersey including the Pennsylvania Turnpike), I-476 (I-95 to Clark Summit including the Pennsylvania Turnpike).

The commercial vehicle travel restriction in New Jersey applies to the length of the following highways in both directions:

- I-78, from the Pennsylvania border to I-95 (New Jersey Turnpike)

- I-80, from the Pennsylvania border to I-95 (New Jersey Turnpike)

- I-195, from I-295 to NJ Route 138

- I-280, from I-80 to I-95 (New Jersey Turnpike)

- I-287, from NJ Route 440 to the New York State border

- I-295, from I-195 to the Scudders Falls Bridge (Pennsylvania border)

- Route 440, from the Outerbridge Crossing to I-287

The restriction does not apply to the New Jersey Turnpike, Garden State Parkway south of exit 105 or the Atlantic City Expressway.

The New Jersey commercial vehicle travel restriction applies to all tractor-trailers, except those listed in this Administrative Order, and empty straight CDL-weight trucks.

Finally, in New York, tandems and empty trailers are banned on the following roads:

- I-84 full length (From Pennsylvania to Connecticut)

- I-684 between I-84 and I-287

- NY Route 17 between I-84 and I-81

- I-87 (NYS Thruway) south of Exit 24 (I-90/I-87 Northway)

- I-287 (Cross Westchester Expressway)

- I-95 (New England Thruway)

- Berkshire Spur

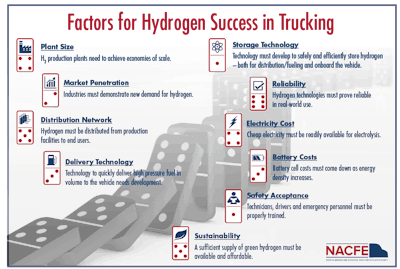

WEIGHING POSSIBILITIES/FACTORS FOR HYDROGEN SUCCESS IN ELECTRIC POWERTRAINS | The North American Council for Freight Efficiency (NACFE) released its latest Guidance Report, “Making Sense of Heavy-Duty Hydrogen Fuel Cell Tractors.” Said the council’s Director of Emerging Technologies and Study Team Manager Rick Mihelic, “Almost every day there is a new announcement about hydrogen fuel cell electric trucks. Even with all the information, there are a lot of unanswered questions. We published this report to help make sense of hydrogen for commercial freight movement.” Key findings show such trucks are only just beginning to see real-world use; their adoption is being driven by regional or national considerations that are much bigger than what exists for trucking fleets. Battery-electric trucks should be the baseline for hydrogen fuel cell electric vehicle (HFCEV) comparisons, rather than any internal combustion engine alternative. The future acceleration of HFCEVs is likely not about the vehicles and fueling but resides mostly on the creation and distribution of the hydrogen itself. The report also offers fleets some recommendations on how to proceed with hydrogen fuel cell electric truck exploration, from how to compare the rigs to what you’re running today to what not to consider — things like fill times, largely at this stage moving targets, at best. Financial incentives to reach such zero-emissions goals, the report’s authors also note, are likely to be needed for some time as vehicles come into production. You can download the NACFE report via this link.

WEIGHING POSSIBILITIES/FACTORS FOR HYDROGEN SUCCESS IN ELECTRIC POWERTRAINS | The North American Council for Freight Efficiency (NACFE) released its latest Guidance Report, “Making Sense of Heavy-Duty Hydrogen Fuel Cell Tractors.” Said the council’s Director of Emerging Technologies and Study Team Manager Rick Mihelic, “Almost every day there is a new announcement about hydrogen fuel cell electric trucks. Even with all the information, there are a lot of unanswered questions. We published this report to help make sense of hydrogen for commercial freight movement.” Key findings show such trucks are only just beginning to see real-world use; their adoption is being driven by regional or national considerations that are much bigger than what exists for trucking fleets. Battery-electric trucks should be the baseline for hydrogen fuel cell electric vehicle (HFCEV) comparisons, rather than any internal combustion engine alternative. The future acceleration of HFCEVs is likely not about the vehicles and fueling but resides mostly on the creation and distribution of the hydrogen itself. The report also offers fleets some recommendations on how to proceed with hydrogen fuel cell electric truck exploration, from how to compare the rigs to what you’re running today to what not to consider — things like fill times, largely at this stage moving targets, at best. Financial incentives to reach such zero-emissions goals, the report’s authors also note, are likely to be needed for some time as vehicles come into production. You can download the NACFE report via this link.More driver pay increases announced

Two large fleets announced driver pay increases, adding to the growing list of carriers boosting pay for their drivers.

C.R. England announced an increase that will affect most of its over-the-road drivers, which it calls “the largest pay increase in C.R. England’s 100-year history.” The increase went into effect Dec. 1 and is estimated to provide an average of 15.5% to the base pay of OTR solo drivers.

Additionally, drivers are also participating in a new bonus program that launched on Nov. 1, which provides incentives for safe driving and superior service performance. Earning top payout on the Safe & On-Time, Every Time Bonus, combined with the base pay increase, is estimated to provide up to a 25% total pay increase for eligible drivers.

Maverick Transportation also announced a pay increase for its flatbed, glass and dedicated divisions. Beginning Jan. 3, Maverick is introducing a new 2 cents-per-mile and 4 cpm increase for the flatbed and glass divisions, respectively. The company is also increasing their tarp pay, short mile pay and guarantee pay for OTR drivers.

The company says student drivers will now earn 51 to 54 cpm, and experienced drivers will earn 56 to 64 cpm, depending upon division and experience.