Dine-in and takeout meals purchased at restaurants while on the road qualify for per diem deductions at a higher rate.Getty Images

Dine-in and takeout meals purchased at restaurants while on the road qualify for per diem deductions at a higher rate.Getty Images

A federal stimulus measure designed to help restaurants can also help owner-operators by increasing their per diem deduction, said business services provider ATBS.

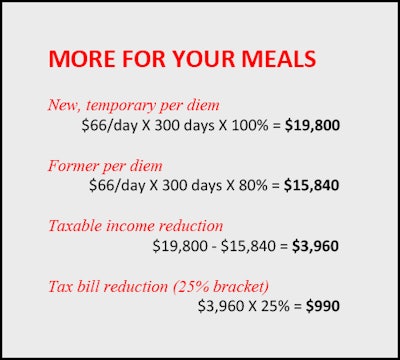

The savings comes from being able to deduct 100% of the cost of restaurant meals while on the road instead of the traditional 80%. It will be in effect for all of tax years 2021 and 2022.

“For example, if you were away from home 300 days in 2021 and purchased all of your meals from restaurants, you could take a meal deduction of $19,800,” said ATBS Tax Manager Michael Schneider. That’s based on $66 per day for 300 days. Under the old formula, at 80%, the deduction would be $15,840. “So the additional deduction from the new rule is nearly $4,000.”

The tax filer’s taxable income would be reduced by that amount. For a client in a 25% marginal tax bracket, the actual tax break would be almost $1,000.

Schneider said the stimulus program increases the business meal deduction from 50% to 100%, encouraging spending in restaurants to help them recover from business lost to the pandemic lockdowns. However, its application to truckers’ per diem wasn’t clear until ATBS held conversations with the IRS.

As a result, Schneider said, the IRS agreed to an ATBS suggestion that a filer estimate the percentage of on-the-road meals bought at a restaurant (dine-in and takeout), which would qualify at 100%. The remaining meals, bought at groceries and convenience stores, would qualify at 80%.

“If you are away from home driving for three weeks and eat three meals a day, you would eat 63 total meals. If you purchased 28 of those meals at a restaurant, then 44% of your meals would be considered purchased at restaurants,” ATBS said. Those qualify for the 100% deduction. The remainder would be at 80%.

[Related: Tax strategy -- to depreciate or not to depreciate major maintenance]

ATBS said final IRS regulations on this per diem aspect are not in place, but it’s the firm’s recommendation, based on its communications with the agency.

As before, the IRS requires records for tax deductions, so ATBS recommends keeping meal receipts and logs that reflect your days spent away from home.

"The regulations explain that a partial day is a day away from home for more than 12 hours, requiring rest to perform your duties," Schneider said. "A full day is a day away from home for more than 24 hours, requiring rest to perform your duties." A partial day qualifies for 75% of the $66 daily amount.

ATBS said it’s adding a per diem tracker feature to its ATBS Mobile App this month.

Readers can find more information about taxes, per diem and more in the updated 2021 edition of the Overdrive’s Partners in Business manual for owner-operators and prospective owner-ops, produced with ATBS and sponsored by TBS Factoring Service. It's available for download via the link.